OPEC Questions Production Cuts, But Crude Oil Resumes the Uptrend

Crude Oil keeps climbing up, although OPEC is hinting that the proposed production cuts might not come into force

OPEC+ has been thinking of cutting Crude Oil production again after they put production quotas on all members late last year. But despite the quotas, Crude Oil has been bearish since the global economy keeps weakening and the demand for Oil keeps declining. Now we are hearing OPEC’s secretary general Barkindo question further production cuts. Here are some of his comments:

- Deeper oil cut is in question now

- Countries are ramping up compliance with deal

- Numbers we are seeing now suggest that 2020 may have upside potential

- Optimistic that oil market is going to gain stability.

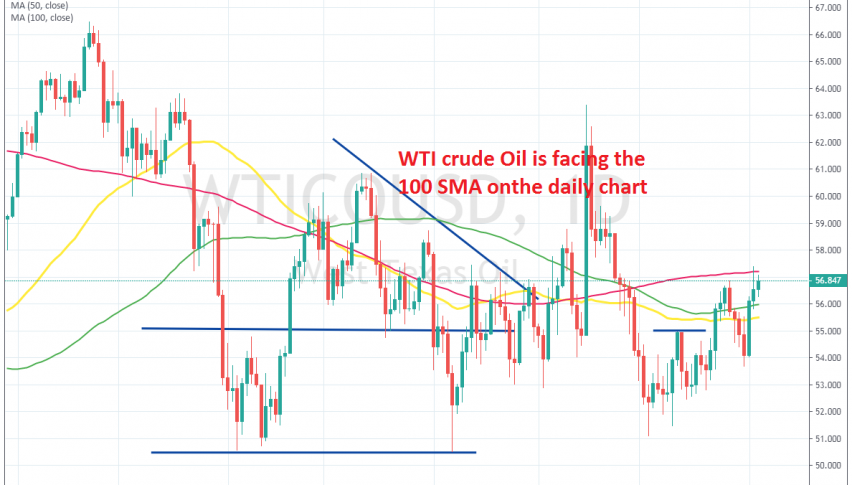

This should be bearish for Crude Oil because the only reason Oil prices have been increasing is the production cut comments from OPEC. Otherwise, the global economy is still weakening instead of improving. Now, WTI Crude Oil has turned bullish again, but it is facing the 100 SMA on the daily chart.

Although, these comments, especially if they are true, should turn Oil bearish again. For now though, traders are not sure what direction OPEC will take, so the next move will come for Oil when there is more clarity on this. If OPEC decides not to cut production again, then Oil should turn really bearish.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account