Short NZD/USD on the Bearish Reversing Setup

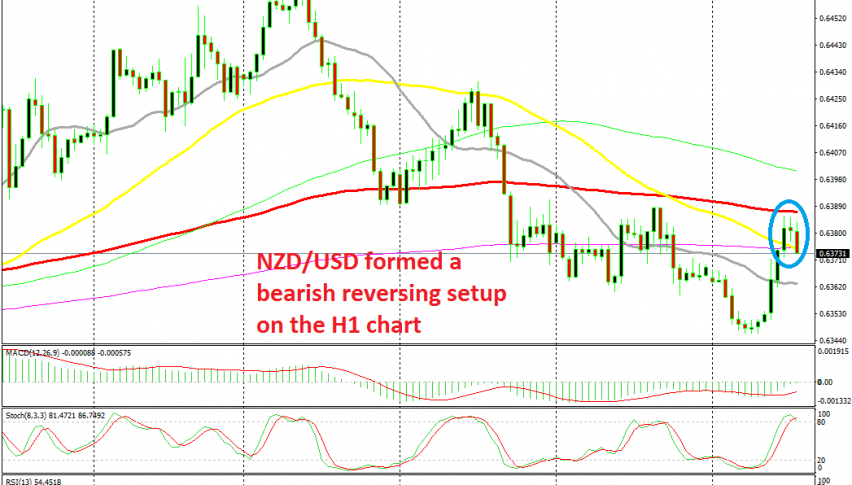

NZD/USD retraced higher earlier today, but the retrace is over now and the bearish trend is resuming again, so we decided to sell this pair

[[NZD/USD]] has been pretty bullish since early October, as the sentiment improved in financial markets, due to the partial trade deal between US and China. The deal is not signed yet, but China promised to remove tariffs on US poultry imports today, which is a step in the right direction.

Those comments improved the sentiment during early European session today and risk assets such as the Kiwi benefited. NZD/USD climbed more than 40 pips higher, but the climb was complete a while ago, with stochastic indicator becoming overbought.

As I highlighted in one of the forex posts this morning, the climb stopped at the 100 SMA (green) on the daily chart on Monday and since then the pressure has been on the down side. So, the trend has been bearish this week and we decided to go with the flow.

So, the pullback higher was complete on the H1 time-frame chart earlier today and the 100 SMA (red) was providing resistance at 0.6390. Besides that, the previous H1 candlestick closed as a doji which is a bearish reversing signal after the retrace higher. So, a bearish reversing chart setup formed below the 100 SMA and we went short on this pair.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account