Buying the Pullback at the 50 SMA on USD/JPY

USD/JPY has retraced lower in the last few hours as we head to the weekend, but the pullback seems complete now.

[[USD/JPY]] turned pretty bullish in October. The sentiment improved in financial markets due to the partial trade deal between US and China and the Brexit deal between the EU and the UK Prime Minister Boris Johnson. As a result, safe havens have suffered, especially the JPY which has been pretty bearish.

The USD has been also bearish in October, but the JPY has been even weaker, hence the uptrend in this pair. USD/JPY made a decent bearish move in the last two day of last week, after the FED cut interest rates for the third time in a row and left the outlook dovish.

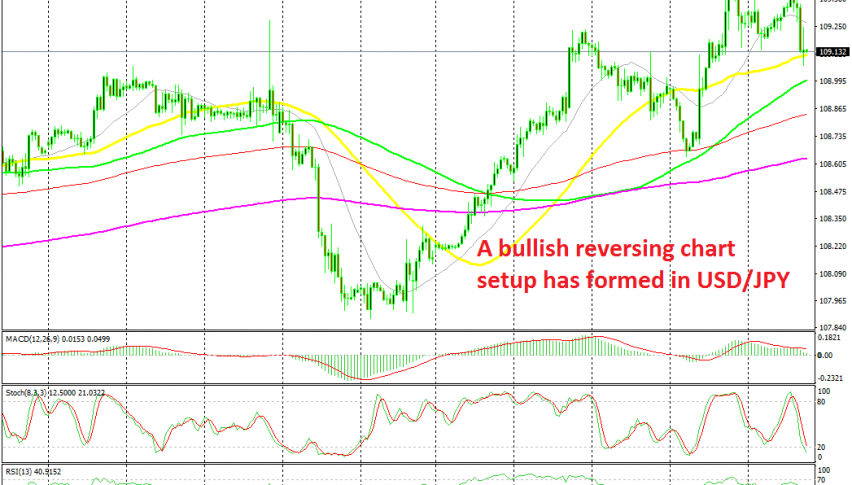

But, the buyers returned for the USD and the uptrend resumed again. this week we saw another pullback lower, which was smaller, but that decline stopped at the 100 SMA (red). So, moving averages have turned into support for this pair. Today, we are seeing another pullback lower as forex traders turn into safe havens before the weekend, just in case something happens over the weekend, and anything can happen.

But, the price is finding support at the 50 SMA (yellow) on the H1 chart. This moving average has been acting as support and resistance before and is doing that job again now. The stochastic indicator is also oversold, which means that the pullback is complete on the H1 chart. The previous candlestick closed as a doji as well, which is a reversing signal,so we decided to go long on this pair.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account