Sellers Remain in Control in USD/JPY as MAs Turn From Support to Resistance, but They Face a Hurdle Now

USD/JPY has turned bearish this week, but sellers face the 100 SMA on the H4 chart now

[[USD/JPY]] has been pretty bullish since early October as the sentiment in financial markets improved, due to the partial trade deal between US and China and the Brexit deal between Boris Johnson and the EU. We did see a dive towards the end of December as the UK parliament voted it down, which hurt the sentiment for a few days.

But the sentiment improved again and the demand for safe havens evaporated, with GOLD turning pretty bearish, particularly last week. Although, this week we are seeing a retrace lower in USD/JPY and today Gold has turned bullish again.

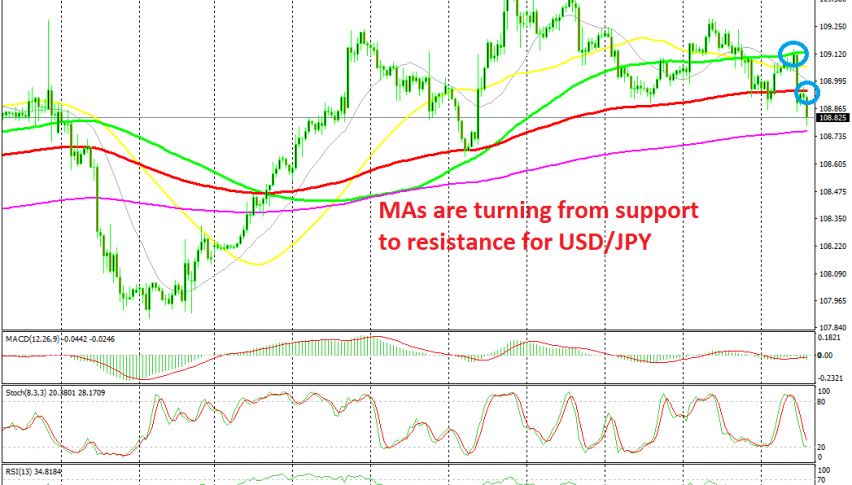

Donald Trump didn’t sound too upbeat yesterday about the trade deal and the civil unrest in Hong Kong continues, so the sentiment has turned slightly negative again today, hence the reversal in USD/JPY and Gold. In the last two days this pair was finding support at the 100 smooth MA (red), but yesterday the 100 simple MA (green) turned into resistance and today the price broke below the 100 smooth MA on the H1 chart. Now this moving average has turned into resistance.

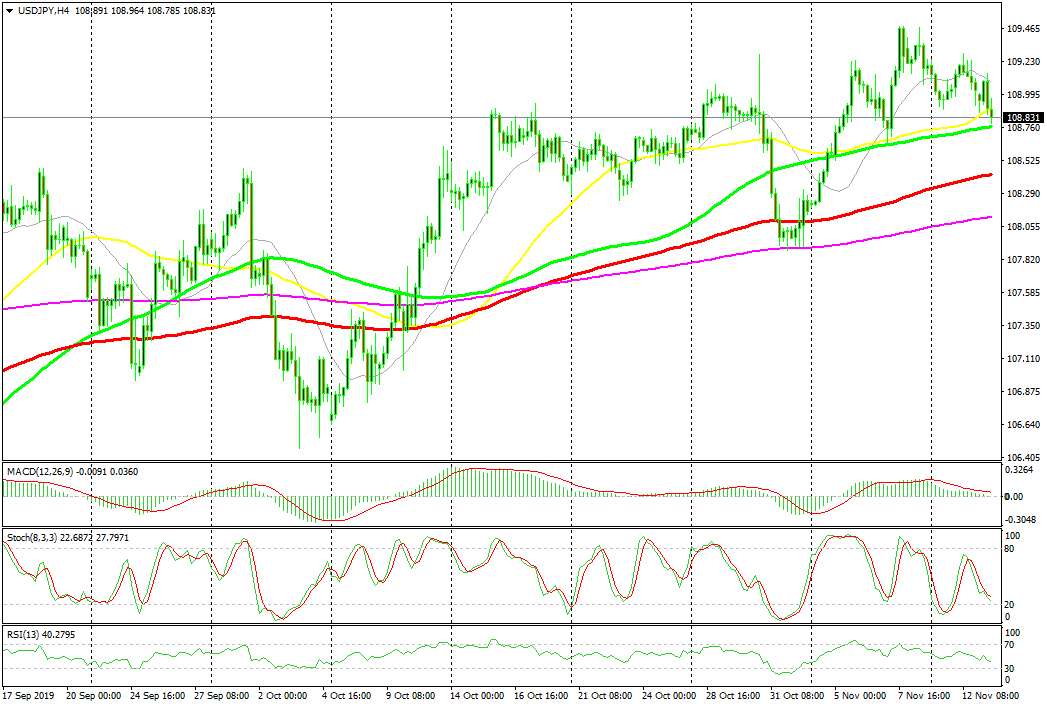

USD/JPY faces the 100 simple MA on the H4 chart

So, the sellers seem in control on the H1 time-frame, as moving averages turn from support to resistance, with the price slipping lower. But, the H4 chart tells us that this might be the end of the decline. The 100 simple MA (green) which provided support last week and reversed the price higher might do the same again now and we are pretty close to it.

Besides that, the stochastic indicator is almost oversold, so the retrace seems complete. If sellers want to keep it going, they have to break this moving average, otherwise a bounce is due soon. We are already long on this forex pair, so we are hoping to see a bounce off the 100 SMA.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account