Forex Signals US Session Brief, Nov 21 – Mixed Comments Leave Traders Uncertain

China is urging for a partial trade deal with the US, which is a positive thing for markets, but geopolitics are interfering with markets

The sentiment improved early today in the European session, after comments from China suggested that another meeting face to face will likely take place between US and China delegations in China, according to the Wall Street Journal. That goes well for risk assets which climbed slightly higher after the report from WSJ was released and bond yields increased. The Chinese Commerce Ministry also added that rumours about possible disagreements in trade talks are not accurate.

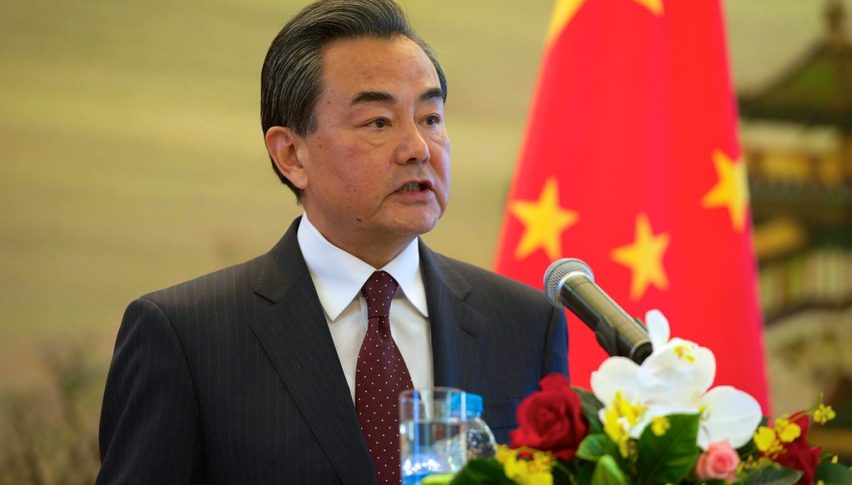

But, China’s Foreign Ministry spokesman, Geng Shuang urged the US to prevent the HK bill from turning into law. This might turn into on of the main issues in the US-China talks. Also, the meeting face to face, might be the make or break meeting for “Phase One” deal. So, nothing is certain right now. later on, when the US session started, we heard some more positive news from China. According to the South China Morning Post, tariffs on Chinese consumer goods slated to go into effect on December 15 will likely be delayed even if both sides can’t reach an agreement. that improved the sentiment further, but it’s still a double edged sword, since markets have anticipated a full removal of them, so traders remain uncertain and markets are trading sideways today.

The European Session

- Positive Comments Form China – China Commerce Ministry said this morning that rumours about possible disagreements in trade talks are not accurate. US, China trade teams will continue close communications and will strive to reach “Phase One” deal with the US. According to the Wall St Journal, citing unnamed sources, Liu He is said to have extended an invite to Lighthizer and Mnuchin last week.

- Negative Comments From China – Foreign Ministry spokesman, Geng Shuang urged the US to prevent the Hong Kong bill from turning into law. A senior Chinese diplomat added later that the US actions severely damages bilateral relations. US has many times interfered with China’s internal affairs. US should meet China halfway to build cooperative, stable bilateral relations.

- Now OPEC Doesn’t Want to Cut Production Further – We have been hearing rumours that OPEC would cut Oil production further in the December meeting, but it was more of a scheme to help crude Oil prices than anything else. Reuters reported today, citing two sources on the matter that OPEC+ reportedly said to have no plans to deepen output cuts in December meeting. Adding that, OPEC+ is likely to extend the existing oil output cuts until June next year when they meet up in Vienna next month.

- ECB Meeting Accounts – The European Central Bank released the minutes from their October meeting. They cut deposit rates further in September and started another QE (quantitative easing) programme, so these accounts held some interest for traders like us, who would like to see what the ECB has in plans after the last monetary easing. Below are the main comments from the meeting accounts:

- Frank discussions necessary but it is important to form consensus

- And to unite behind inflation goal

- Economic data raised question as to whether weakness would continue for longer than anticipated during September meeting

- There was wide agreement that more information is needed to reassess the inflation outlook and impact of ECB measures

- Strong call for unity was made at October meeting

The US Session

- US Philly FED Manufacturing Index – Philly FED manufacturing index was released a while ago. It was expected to improve slightly from 5.6 points in October to 6 points this month. But, this indicator jumped to 10.4 points, beating expectations. But, the details are pretty weak once again, as employment declined to 21.5 points from 32.9 prior. New orders also declined to 8.4 points form 26.2 points in October. New orders also declined to 8.4 points form 26.2 points in October. Prices paid fell to 7.8 points form 16.8 prior. Only the future index increased to 35.8 points from 33.8 last month.

- BOC’s Poloz Doesn’t Feel to Dovish – Bank of Canada Governor Stephen Poloz commented a while ago, saying that he thinks monetary conditions are ‘about right’. Canadian economy is in a good place overall. We’re still quite stimulative where we are today. We want to do whatever we can to boost trend line. Starting to see glimmer of response in global easing. Global financial conditions have eased a lot.

- Eurozone Consumer Confidence – Consumer confidence turned negative earlier this year in Europe and fell to -7 points, where it remained for many months. Last month though, it fell further to -7.6 points, but it was expected to improve a bit today to -7.3 points. It improved further to -7.2 points, which is a good sign.

Trades in Sight

Bearish EUR/USD

- The trend is still bearish

- The retrace higher is complete

- The 200 SMA provided resistance

The 200 SMA has ben providing resistance for the last two days

EUR/USD turned bearish in the last week of November, after the USD completed a bearish leg back then. The price bounced off the 100 SMA (green) but failed to move above the previous high at 1.1180 which provided resistance again. The 200 SMA (red) provided support as well for some time last week, but it was eventually broken. Although, it turned into resistance earlier this week, when this pair retraced higher. The price bounced off the 100 SMA but the 200 SMA provided resistance again today and now EUR/USD is heading lower again.

In Conclusion

The FOMC minutes didn’t offer much that we didn’t know yesterday in the evening, but they left markets a bit dovish. Although, the sentiment improved today on positive China comments, but we also heard some negative comments regarding Hong Kong. So, markets remain uncertain now.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account