Bullish GBP/USD Today, But Buyers Hesitate at MAs

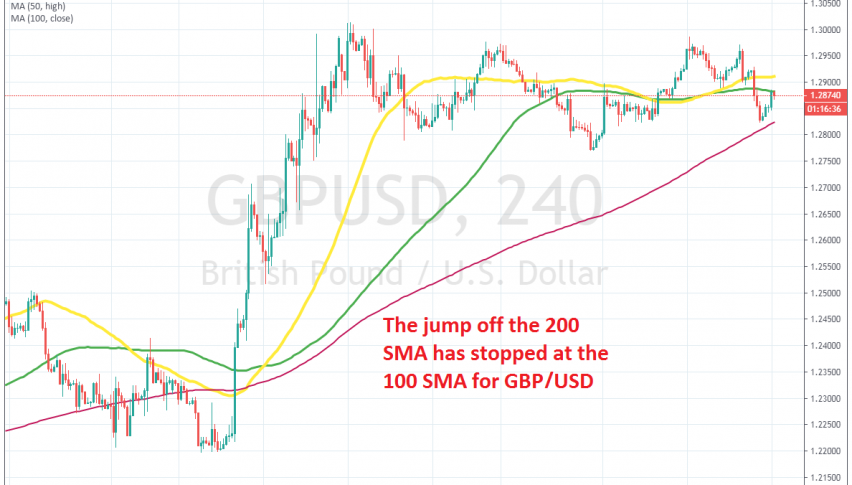

GBP/USD has turned bullish today after the decline last week, but the 100 SMA is stopping buyers from pushing higher

[[GBP/USD]] turned extremely bullish during October, gaining around 800 pips that month, after the Boris Johnson and the EU reached a Brexit deal. But, the deal was voted off by the British Parliament and the surge stopped for the GBP. The price just pierced the big round level at 1.30, but retraced lower, which means that 1.30 is the big target to take out for the buyers.

The UK is heading towards general elections now, which will be held on December 12. That increased the uncertainty in the beginning, but the odds of Boris Johnson gaining a clear majority with Conservatives have increased,which should be a positive thing for the GBP.

Although, traders are not certain exactly how things will evolve, so as a result, the GBP has traded sideways for more than a month. At the end of last week, GBP/USD moved lower, losing more than 150 pips, but the decline stopped at the 200 SMA (red) on the H4 chart.

The price reversed from there and today this pair has been pretty bullish. But, the 100 SMA (green) which has acted as support and resistance before, is acting as resistance now. So, buyers are having a tough time here below the 100 SMA, so let’s see if they can push above it, which would open the road for the top at 1.2980-1.30.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account