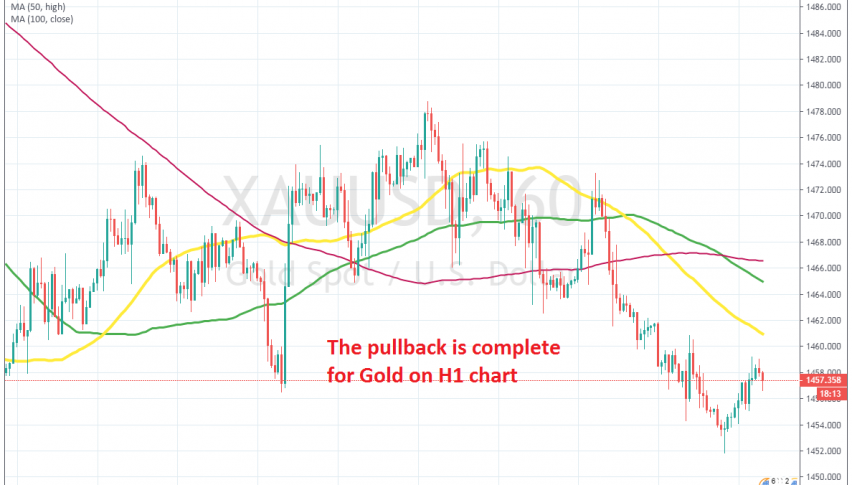

The Pullback Seems Complete in Gold

Gold has been bearish this month and retraces higher should be seen as good opportunities to sell

GOLD was trading sideways in October after turning bearish in September. But, in the first week of this month Gold resumed the bearish trend and made a strong bearish move, losing around $70. The price fell to $1,445; it used to be a resistance area but now it turned into support for Gold.

In the last two weeks, Gold retraced higher on the daily chart, as the sentiment deteriorated a bit on comments from Donald Trump that the Phase One deal might be postponed. The protests in Hong Kong also had a negative impact on sentiment in financial markets, hence the retrace higher.

But, the retrace ended last week and the downtrend resumed again. Today we saw a smaller retrace higher on the H1 chart. That started after the doji candlestick, which is a reversing signal. But, the retrace seems complete now. Stochastic is overbought and the previous candlestick closed as an upside-down hammer.

The current candlestick looks bearish, which shows that the retrace is ending. China and the US are very close to signing the Phase One deal, as we heard yesterday, so Gold should remain bearish as the sentiment improves. This might be a good chance to sell Gold, so we are following the price action to see if we can open a trade here.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account