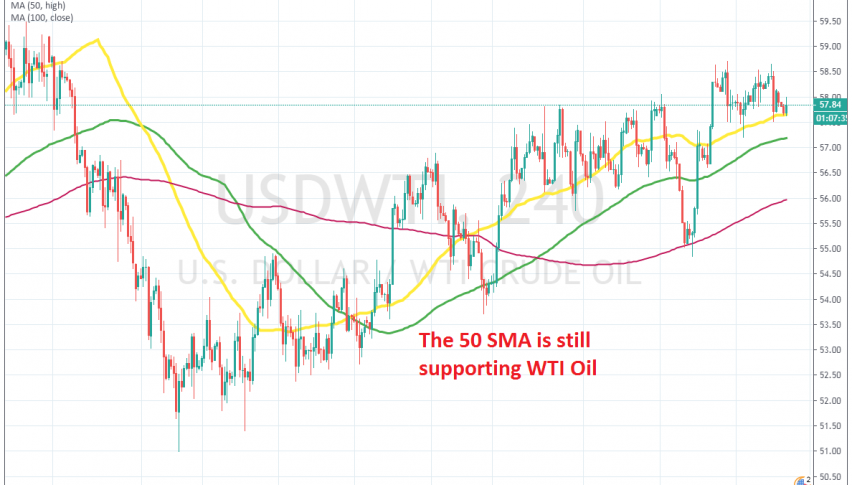

The Uptrend Continues for WTI Oil as the 50 SMA Turns Into Support

Crude Oil remains bullish on hopes that OPEC+ might decide to cut production again in December

Crude Oil turned bullish by the middle of October, after rumours from OPEC countries that they might put new production quotas in place, curbing Oil production further. This improved the sentiment for WTI Oil which turned bullish after reversing at the support zone above $50.

The global economy continues to weaken, which has been keeping Crude Oil bullish in recent months; but the idea that OPEC+ might cut production again has had a bigger effect on Oil prices, keeping WTI on a bullish trend for more than a month.

Recent comments from Russia and other OPEC+ countries in the last couple of weeks show that they don’t like the idea, since most of their income comes from oil exports. On top of that, their economies have weakened, just like in the rest of the globe, so they can’t afford to lower their revenues.

I don’t think they will cut production further, but Crude Oil has been pushing higher nonetheless. Moving averages have done a good job in keeping the bullish momentum going, with larger period MAs coming into play during deeper pullbacks and smaller MAs providing support during shallower ones.

This week, the 50 MSA (yellow) has been providing support several times and now the price is bouncing off this moving average again. We might decide to go long from here, but will follow the price action for some time, looking for a bullish reversing candlestick.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account