USD/CAD Keeps the Bullish Trend

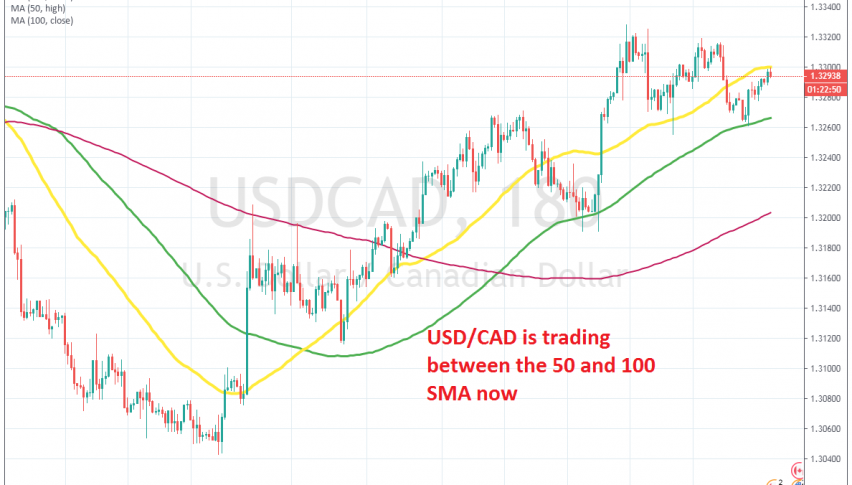

USD/CAD has bounced off the 100 SMA, but it is finding resistance at the 50 SMA today

[[USD/CAD]] was pretty bearish during October, following the decline in the USD after manufacturing activity fell deeper in contraction. Risk assets, on the other hand, such as commodity Dollars benefited from the improvement in the sentiment, due to the partial trade deal between US and China.

But, the decline stopped above 1.30, which seems to have formed a strong support zone. USD/CAD reversed from there and since then the trend has been bullish for this pair. We saw a surge to the 200 SMA (purple), which provided resistance.

The price retraced down after being rejected by the 200 SMA , but the 50 SMA (yellow) turned into support for this pair. The 50 SMA has been pushing the price higher since then, and whenever it has failed, the 100 SMA (green) has taken its place.

Earlier this week, we saw a retrace down to the 100 MA, which held once again, but the price is finding resistance at the 50 SMA now. So, there’s a small battle going on below the 50 SMA now. If it holds, then we might see a pullback to the 100 SMA again; if not, then the bullish momentum will continue and the uptrend might stretch further.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account