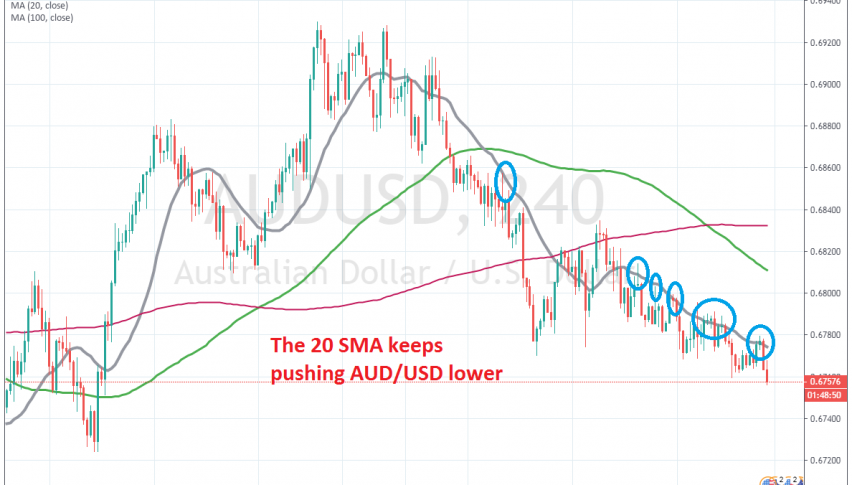

AUD/USD Reversed at the 20 SMA Once Again

AUD/USD

[[AUD/USD]] was pretty bullish during October, as the sentiment improved in financial markets, on the prospect of a partial deal between US and China. Risk assets such as the Aussie, rallied higher. But, the climb ended at the beginning of this month, after the Phase One deal wasn’t so easy to become official.

So, the flow shifted in AUD/USD and moving averages turned from support into resistance. The 20 SMA (grey) has turned into a trend definer for this pair, as it keeps pushing the price down. But, the 200 SMA (red) has also come to rescue for sellers, when the 20 SMA has failed.

This week, the 20 SMA has been the ultimate resistance for this pair on the H4 chart. It has effectively reversed the price down every time, despite being pierced several times. Earlier today, we saw AUD/USD retrace higher to the 20 SMA once again, but the price formed a morning star candlestick right at that moving average. That’s a reversing signal and the reversal took place immediately after that. We decided to open a sell signal at the 20 SMA, so our trade is well in profit now.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account