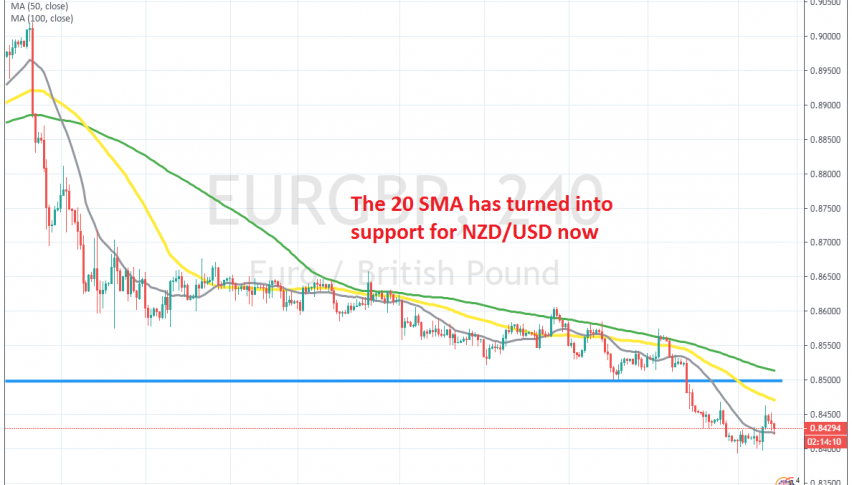

The 20 SMA Turns From Resistance Into Support for EUR/GBP

EUR/GBP has been bearish for a long time, but climbed higher yesterday and now the 20 SMA has turned into support on the H4 chart

EUR/GBP turned really bearish in August, after manufacturing PMI fell deeper in contraction that month in Germany and the Eurozone. We saw a decent retrace by the end of September/early October, but the sellers regained control after Boris Johnson and the EU reached a Brexit deal.

The deal didn’t pass the British Parliament as we know, hence the general elections tomorrow, but the downtrend has continued to stretch further down. The 20 SMA (grey) turned into resistance for this pair in the second half of October, after sellers returned again.

After that, it has been the 50 SMA (yellow) and especially the 100 SMA (green), which have been providing resistance on pullbacks higher. Last week, the 20 SMA took its turn again, as the downtrend resumed, but yesterday we saw a 100 pip decline in the GBP, which sent this pair higher. The price pushed above the 20 SMA, which seems to have turned into support now. So, this moving average might be a good place to try a small buy trade from here.

Although, Conservatives have a decent lead on the Labour Party. So, they will win a clear majority in the elections tomorrow, which means further upside for the GBP on a relief rally. So, the downtrend will likely stretch further after that, but the volatility is going to be pretty high, which means that is a difficult trade.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account