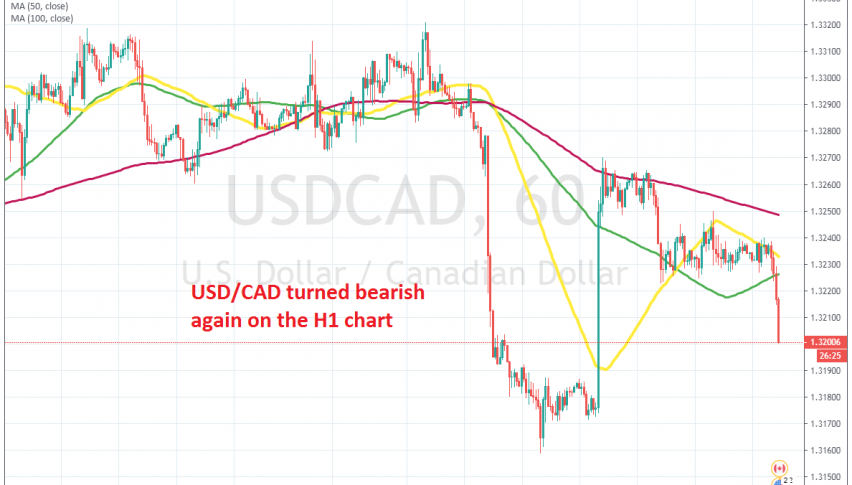

USD/CAD Reverses at the 50 SMA This Time

USD/CAD has turned bearish now, after failing to break the 50 SMA earlier today

[[USD/CAD]] has turned bearish this month, after comments from OPEC for a further cut in Crude Oil production, which helped oil prices climb higher. At some point last week, we saw a surge in USD/CAD, after Russian Energy Minister said that he would have liked OPEC+ to postpone further cuts in production until next summer.

But, the bullish trend in crude Oil which has been going on since mid September kept going and the price reached pretty close to $60 in US WTI crude, after OPEC decided to cut production by 50k bpd. Although, WTI crude has retreated down from that level and it’s trading at $58.50s now.

Nonetheless, USD/CAD has turned bearish again after failing to break the 50 SMA (yellow) which acted as resistance on the hourly chart. Now, the price is trading 40 pips lower from the 50 SMA, despite crude Oil retracing lower. So, it seems like forex traders are pulling away from the USD ahead of the FED meeting later in the evening.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account