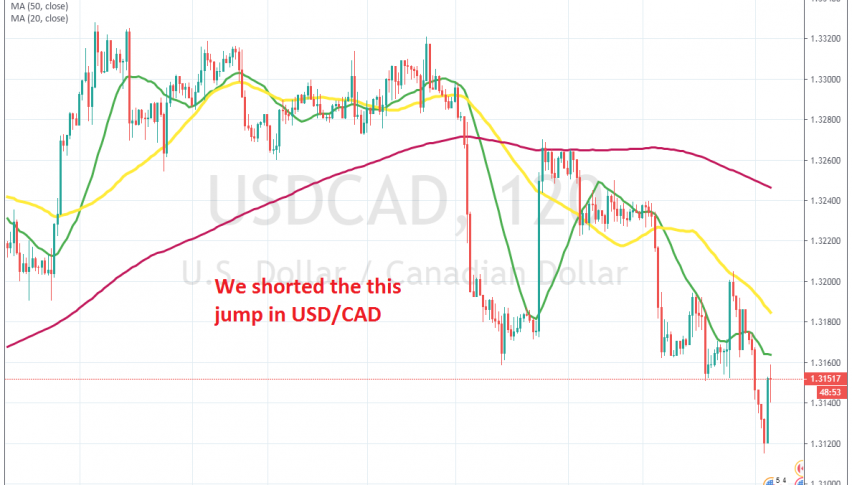

USD/CAD Bounces After Canadian Government Increases Deficit Forecasts

USD/CAD has turned pretty bearish this month, but it bumped after Canadian Government revised deficit forecasts

•

Last updated: Monday, December 16, 2019

[[USD/CAD]] has been trading on a bearish trend since the beginning of this month. It had two reasons to do so; first, it turned bearish after the US ISM manufacturing report showed further contraction in this sector which turned the USD bearish and second, OPEC+ decided to cut production quotas again, by 50 barrels/day this time, which turned the CAD bullish.

Although, we are seeing a 40 pip bounce now, after seeing deficit revisions from the Canadian government. Below are some of the main figures:

Canada boosts deficit forecasts

- Sees 2020-21 deficit of C$28.1B from $19.7B in March

- Sees 2019-2020 deficit of $26.6B from $19.8B

- Sees 31% deficit-to-GDP in 2019-2020 falling to 29.1% by 2024-25

- Update shows slightly better revenues in 2019 and 2020

Finance Minister Bill Morneau said the rise in the deficit is because of a pension accounting issue. That’s not necessarily nefarious. The Federal government and the provinces have been struggling with accounting rules around pensions and obligations. So, this doesn’t seem like a serious thing, and I expect a reversal soon, unless the USD becomes really attractive soon for whatever reason,which is not very likely.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.