Forex Signals US Session Brief, Dec 31 – Year-End Cash Flows Dominate Again

Markets have been pretty quiet in recent weeks, but they are moving again this week as year-end cash flows dominate markets

We have seen some decent price action in financial markets this week. Markets have been pretty slow in recent weeks, since the UK elections and the Phase One agreement earlier this month. The initial optimism after those two events faded and the risk rally stopped. traders were uncertain what direction to take, hence the slow price action since then. Although, the volatility has returned again as year-end cash flows dominate markets, as well as some position adjustment from forex traders.

Stock markets have been retreating lower as a result, as well as the bond market. Although, the USD has been leading the decline. Cash flows of multinational corporations have hurt the USD, which points to USD flowing out of the US. Usually, it’s the other way around, but we are not leaving in normal times now, if you haven’t noticed. The other factor for this retreat in the USD is the fact that forex traders have been mostly bullish on USD for the last two years. Now traders are closing some of those long term buy positions, which is pushing the USD down. Risk currencies have been climbing against the USD, but that’s due to the USD weakness, since safe havens have been climbing higher as well.

The European Session

-

EU Trade Commissioner Nominee Speaking on Brexit – Phil Hogan who was nominated as the EU trade commissioner last month, made some comments on Brexit. Boris Johnson will renege on his legal commitment to exit the Brexit transition period by the end of 2020. “In the past, we saw the way the prime minister promised to die in the ditch rather than extend the deadline for Brexit, only for him to do just that. I don’t believe prime minister Johnson will die in the ditch over the timeline for the future relationship either.”

- UK to Increase Minimum Wage – The UK finance minister Sajid Javid says the national living wage will jump by 6.2% (to GBP 8.72) from April 2020. The UK National Living Wage is the minimum wage, its currently:

- for those 25 & over £8.21 per hour

- for those 21-24, £7.70

- ages 18-20, £6.15

- More Progress for the Phase One Deal – Top China trade negotiator Liu He will lead a trade delegation to Washington on Saturday, according to a SCMP report. They agreed on this deal earlier this month, which helped the sentiment in financial markets and now they will make it official. Although, markets are not satisfied with this deal.

The US Session

- Navarro Suggesting more Trade Deals – US trade representative Peter Navarro was speaking on CNBC a while ago,saying that China is just one of several trade deals. China phase I deal in the bank. We look forward to more trade deals in 2020. Navarro Expects UK, Vietnam, Europe trade talks in 2020. China deal has intellectual property theft pieces that were agreed. In China deal have a base application for technology transfers, as well as financial market access for banks and insurance companies.

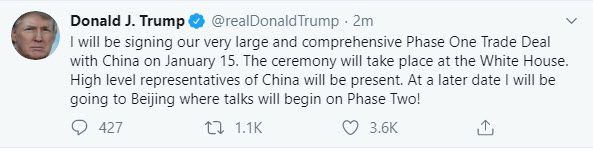

- Donald Trump Tweeting on China Deal – US President Trump tweeted about phase 1 trade deal signing date.

- US CB Consumer Confidence – The US CB consumer confidence was just released. Confidence was expected to jump to 128.0 points among the US consumer. it did improve to 126.5 points, from 125.5 previously, but it missed expectations nonetheless. Present situation also improved to 170.0 points, from 166.9 points last month. Expectations declined slightly though, to 97.4 points from 97.9 last month.

Trades in Sight

Bullish AUD/USD Again

- The trend has ben bullish for more than 2 months

- The upside is gaining further momentum

- MAs are pushing the price higher

The uptrend is picking up pace further

AUD/USD has been bullish since the beginning of this month, as the USD turned bearish, on softer US ISM manufacturing report, which showed that this sector fell deeper into contraction during November. The upside momentum faded and in the third week this pair retraced lower. But, the sentiment improved further after US and China agreed on Phase One deal, helping risk assets, such as the stock markets and commodity Dollars. As a result, AUD/USD has been bullish for about a week. The uptrend has been pretty straightforward. The price has bean leaning on the 20 SMA (grey) on the H1 chart, which has been providing support on pullbacks and pushing the price higher. This shows that the trend is pretty strong. The other moving averages have been helping as well, when the retrace was deeper, so they are pushing this pair higher.

In Conclusion

The year-end cash flow has been sparking some life in markets, especially in safe havens which have been climbing higher since the last few trading sessions. The USD is also declining fast today as traders close some of their long term USD buy positions, so the price action is a bit irrational now and will continue to do so until markets reopen again on Thursday, or perhaps it might continue so until next Monday.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

.png)