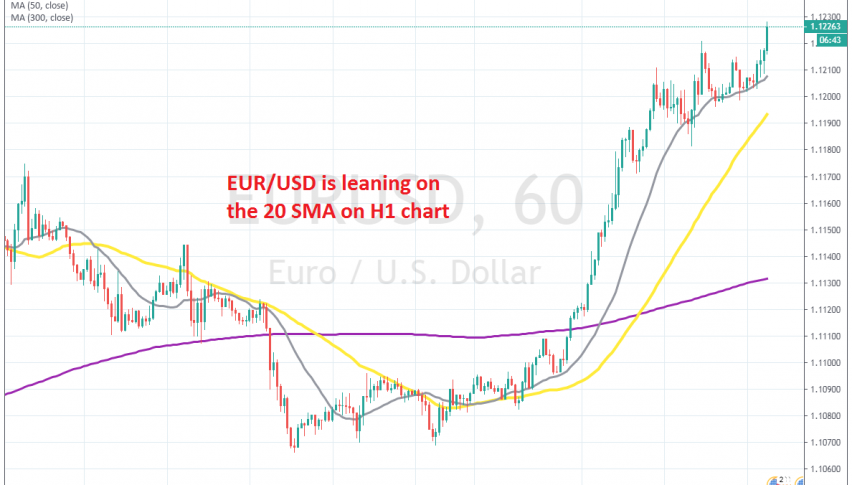

The 20 SMA is Keeping EUR/USD Bullish

EUR/USD has been bullish all this month and the 20 SMA is keeping it that way, pushing the price higher on pullbacks

[[EUR/USD]] has been bullish throughout this month. We saw a move higher at the beginning of this month, after the US ISM manufacturing report showed a deeper contraction last month, instead of improving. The USD turned bearish across the board after that on fears that the US economy might be heading the same direction as Germany, where manufacturing has been in deep recession for quite some time.

In the third week, we saw a retrace down on this pair, after the optimism following the Phase One deal between US and China and UK elections faded quickly. Risk assets such as stock markets retreated lower during that period. But, the USD weakness returned again.

Forex traders are doing some position adjustment ahead of the new year and it seems like they are closing some of their long term buy position in the USD, since the Buck has been bullish this year again.

EUR/USD has climbed more than 100 pips and the 20 SMA (grey) is providing support on the H1 chat. This shows that the trend is pretty strong and buyers are in total control. We will try to go long at this moving average, but only when a retrace down is complete.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account