Oil Continues to Retreat, as US-Iran Tensions Abate

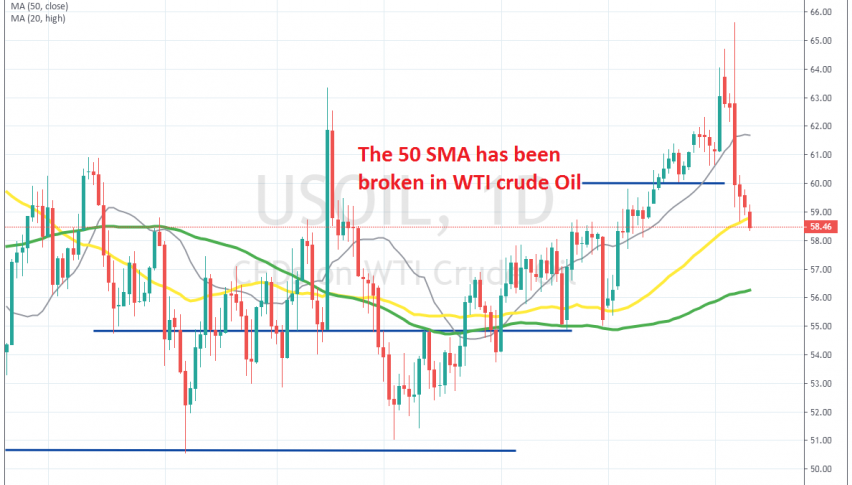

Crude Oil has been bullish for months, but it has made a swift reversal now and slipped below the 50 SMA

The global economy has been weakening, which has decreased the demand for energy, but Crude Oil has been bullish nonetheless. OPEC+ has done a large part in this uptrend, after placing production quotas for the second time in December, this time by an additional 50k barrels/day.

So, Crude Oil has been bullish in the last several months of 2019, while in the first week of this year, tensions in the Middle East sent Oil prices surging higher. WTI crude surged higher after the killing of Soleimani and it made another bullish move after Iran attacked US bases in Iraq.

But, there was no follow through from the US, so tensions have de-escalated. Trump made it clear that he wants de-escalation, while Iran shot a blank round, by not killing any US personnel during the attacks.

So, Crude Oil has been retreating lower and today it slipped below the 50 SMA (yellow) on the daily chart, which has been providing support for a couple of days. Now sellers have taken control in Oil and I expect WTI to fall to $56, where the 100 SMA (green) stands. There, we will see if Oil forms a bullish reversing signal/pattern and if it does, we might open a small long signal from there.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account