Daily Brief, Jan 14: Economic Events Outlook – US Inflation in Highlights

Today, the U.S. Inflation data will remain in highlights, and it may impact gold and dollar prices. Economists are expected a slight drop...

Good morning, traders.

As anticipated, the markets continued to trade on stronger dollar sentiments on the back of 3.5% unemployment rate from the US. The greenback surged higher ere a dense week of economic data, whereas the British Pound was the weakest player following moderate growth that raised the probability that the Bank of England will decrease interest rates this month.

Today, the US Inflation data will remain in highlights, and it may impact gold and dollar prices. Economists are expecting a slight drop in the figure for the CPI, but Core CPI is expected to remain neutral, which will be a good sign for the US dollar. It’s coming out at 22:30, let’s keep an eye on it.

Watchlist – Economic Events Outlook

CPI m/m – 13:30 GMT

For all the newbies, the Core Consumer Price Index (CPI) covers the changes in the price of goods and services, excluding food and energy. A higher than expected reading should be taken as positive/bullish for the USD, while a lower than expected reading should be taken as negative/bearish for the USD.

Lately, the US Federal Reserve has been displaying impediment with the lack of inflation – which is a global aspect. The numbers for December will likely record that the Core Consumer Price Index – the most vital number – settled around 2.3% reported in December. Both headline and core monthly figures carry forecasts for an expansion of 0.2%.

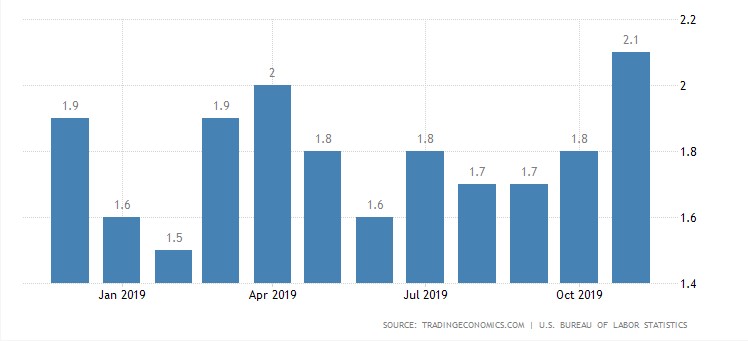

The US annual inflation rate accelerated to 2.1% in November 2019 from 1.8% in the prior month and above the market forecast of 2.0%. It’s the highest inflation rate since November 2018, as food inflation was slight while energy prices sank at a much slower pace.

The core inflation rate, which eliminates volatile objects such as food and energy, was stable at 2.3%, in line with economists’ anticipation. Inflation Rate in the United States averaged 3.25% from 1914 until 2019, seizing an all-time high of 23.70% in June of 1920 and a historic low of -15.80% in June of 1921.

Today, economists are expecting CPI to gain around 0.2% vs. 0.3% rise beforehand. Whereas, the Core CPI is expected to remain unchanged at 0.2% rate today.

US FOMC Member Williams Speaks – 14:00 GMT

The Federal Reserve Bank of New York President is due to speak about the culture in financial services at a workshop hosted by the London School of Economics at 14:00 GMT. Since audience questions are expected, and we should be monitoring the speech for unprecedented answers as they may drive some volatility in the market.

Good luck for the day!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account