Gold Seems to Have Turned Bearish

Gold has been bullish for a long time, but it might be turning bearish now as the sentiment improves

GOLD has been bullish for a long time, as the global economy has weakened, the trade war escalated and major central banks turning dovish. So, traders turned into safe havens and in particular Gold, which has been surging. Geopolitical tensions in the first week of this year between US and Iran have helped keep Gold bullish.

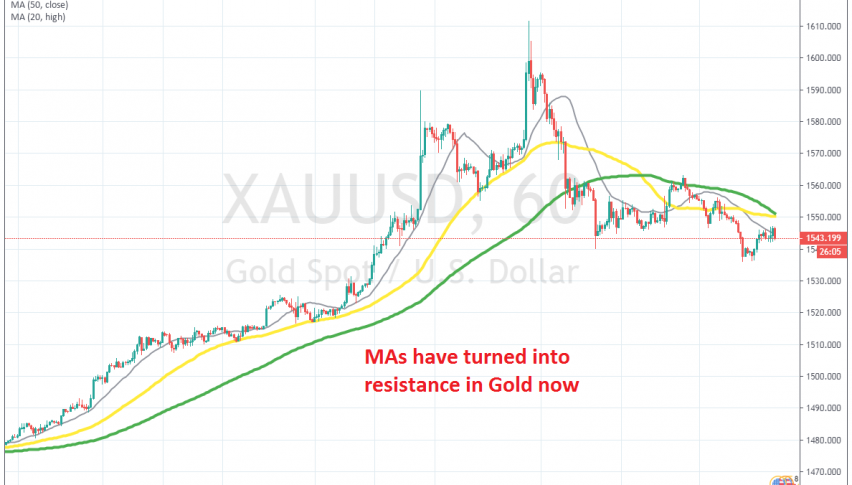

But, the tensions abated in the Middle East, as US didn’t follow through after Iran attacked US military bases in Iraq. Tensions have de-escalated now and safe havens have retreated lower. Gold has lost around $75 from top to bottom and moving averages have now turned into resistance.

The 100 SMA (green) did a great job as resistance yesterday during the retrace higher on the H1 chart and today the retrace seems to have ended below the 50 SMA (yellow). That shows that the selling pressure is strong in Gold. The Phase One deal will be signed tomorrow, which will improve the sentiment further, so Gold should remain bearish for some time.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account