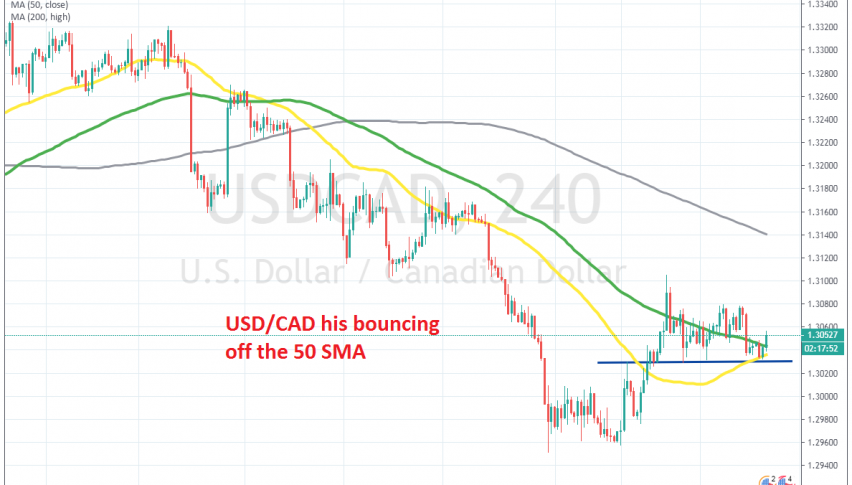

Going Long on USD/CAD at the 1.30 Resistance

[[USD/CAD]] turned bearish in December, as the CAD turned bullish, following crude Oil after OPEC+ decided to cut production again and place new quotas of 50k barrels/day, on top of the previous ones. As a result, USD/CAD remained bearish all months and lost nearly 400 pips from top to bottom.

This pair slipped below 1.30 at the end of the month, but reversed higher this month. The tensions in the Middle East gave crude Oil a push higher, but tensions abated after the US didn’t decide to attack Iran back, after Iran retaliated on US military bases in Iraq.

So, crude Oil retreated lower, with WTI losing around 8 cents and as a result, USD/CAD turned bullish, climbing above 1.30 again. Last week, this pair climbed just above 1.31, but it has been retracing lower this week. Although, it seems like a support level has formed at 1.30 and the retrace is now complete.

So we decided to go long on this pair and opened a buy signal a while ago. The 50 SMA also played a role in providing support and reversing the price higher today. Now, USD/CAD has bounced off the 50 SMA (yellow) after the positive US retail sales for December, so this trade seems to be going well now.