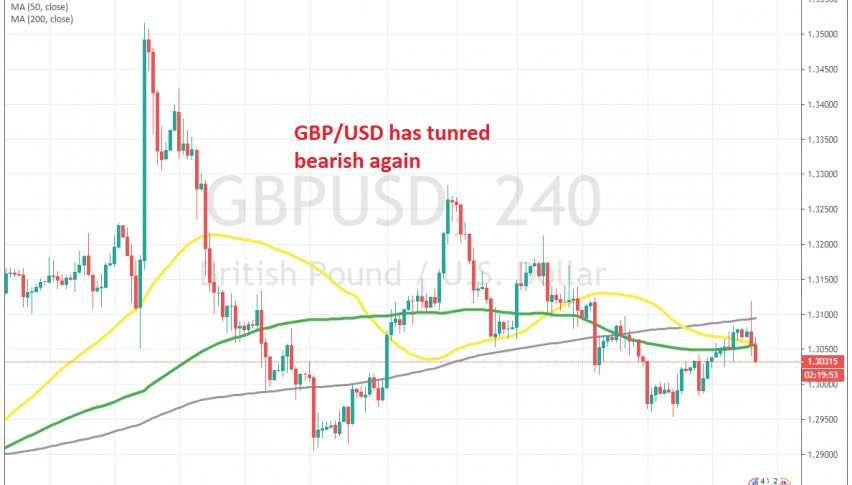

GBP/USD Turns Sharply Lower After Another Disappointing Retail Sales Report

UK retail sales was another disappointing one and the GBP has tumbled on prospects of the BOE cutting rates this month

The UK retail sales for December was released a while ago and it was yet another disappointing report. Retail sales posted another decline of 0.6% in December, which is the fourth decline in the last five months. The GBP has turned bearish immediately after that and has lost nearly 100 pips. Below are the details:

- UK December retail sales -0.6% vs +0.6% m/m expected

- Prior -0.6%; revised to -0.8%

- Retail sales +0.9% vs +2.7% y/y expected

- Prior +1.0%; revised to +0.8%

- Retail sales (ex autos, fuel) -0.8% vs +0.8% m/m expected

- Prior -0.6%; revised to -0.8%

- Retail sales (ex autos, fuel) +0.7% vs +3.0% y/y expected

- Prior +0.8%; revised to +0.6%

The revision for November was negative as well, from -0.6% to -0.8%. YoY sales also came much lower at 0.9% against 2.7% and the previous number was revised lower too, from 1.0% to 0.8%. Core sales were also very disappointing, showing a 0.8% decline last month.

Everything is piling up for the Bank of England to cut interest rates and odds of them doing so at the end of this month now stand above 50%, so the GBP should remain bearish until then.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account