DOW Futures Test 38% Fibby

Crisis trading is no joke. As more confirmed cases of the coronavirus become public, the DOW will very likely continue to take a hit.

For the first time in 2020, the DOW is poised to close a trading week in negative territory. Sentiment continues to sour as the DJIA DOW (-162), S&P 500 SPX (-25), and NASDAQ (-65) are all deep into the red. Sellers have dominated the action for most of the past four sessions. As a result, prices are on the verge of challenging the January uptrend in U.S. stocks.

It has been more of the same this morning on Wall Street, with investors choosing to limit risk ahead of pending uncertainty. Earlier, the CDC confirmed a second case of the coronavirus in the United States and that they are monitoring 63 patients closely. The news comes on the heels of China locking-down three cities amid fears of a widespread outbreak.

Although it remains to be seen how serious the virus may turn out to be, investors aren’t taking any chances. Gold is up another $5.00+ per ounce, with the DOW pulling back about 0.50%.

Crisis Trading Has Gold Up, DOW Down

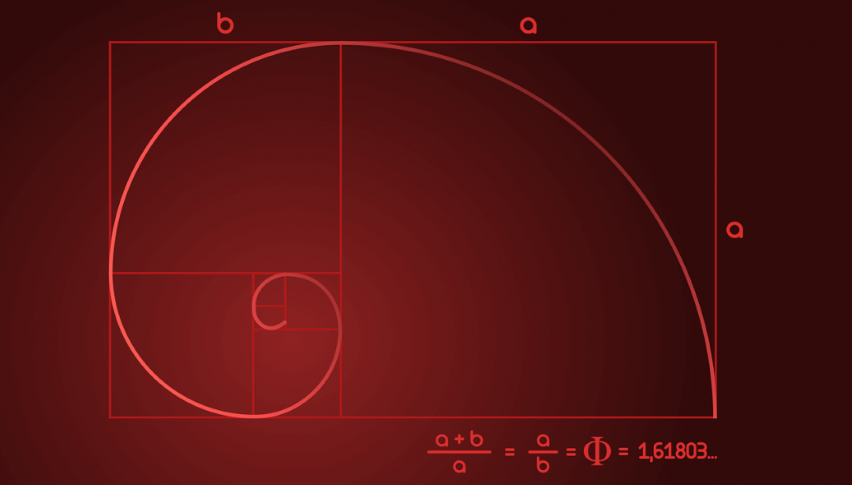

In a Live Market Update from Wednesday, I outlined a long trading plan in the March E-mini DOW. If you missed it, check it out here. (*In the update,the 38% Retracement of 2019’s Range should read 38% Retracement of 2020’s Range.)

The trade turned out to be a success, generating 175 ticks in profit. It also told us one other thing ― equities players are buying dips!

++1_24_2020.jpg)

Here are a few levels to watch for the near future in the March E-mini DOW:

- Resistance(1): Swing High, 29362

- Support(1): 38% Of 2020’s Range, 28874

- Support(2): Bollinger MP, 28805

Bottom Line: Crisis trading is no joke. In the event that more confirmed cases of the coronavirus become public over the weekend, the DOW will very likely continue to take a hit.

For now, if it isn’t broken, don’t fix it. Until elected, I will have buy orders in queue from just above 2020’s 38% Fibonacci Retracement at 28876. With an initial stop loss at 28774, this trade produces 100 ticks on a slightly sub-1:1 risk vs reward management plan.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account