OPEC Slashes Demand Forecasts, But Oil Stretches the Reversal Higher

Crude Oil has ben bearish for more than a month, but it has retraced higher today on better sentiment

•

Last updated: Wednesday, February 12, 2020

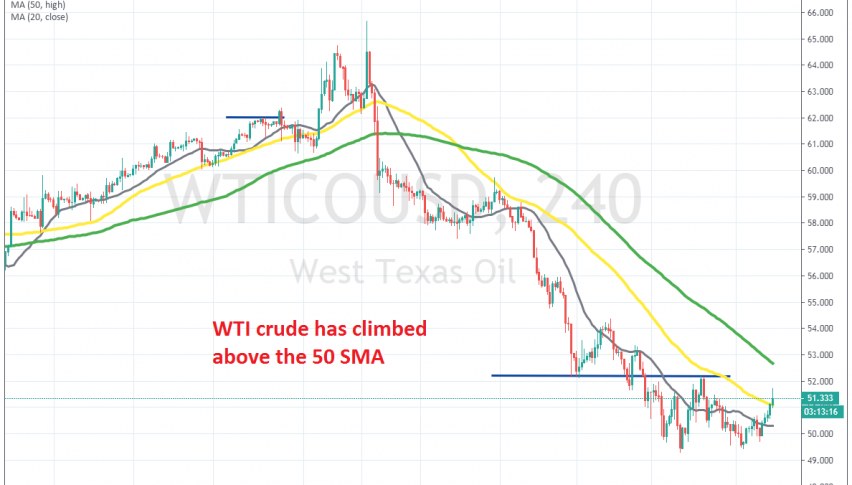

Crude Oil has been really bearish since the second week of January, after it became evident that the US wasn’t going to open another war front in Iran. Oil reversed down after that and coronavirus sent it down the drain. US WTI Oil has lost more than $16 from top to bottom, falling below $50, but today we are seeing a pullback higher, as the sentiment improves a little.

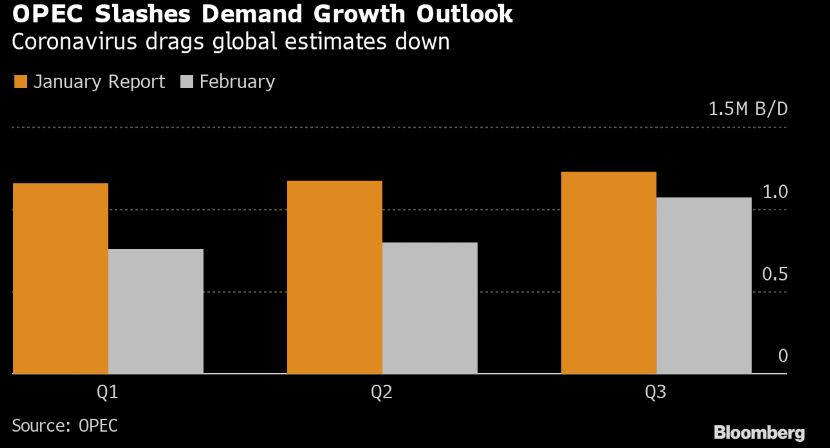

OPEC released its latest report on the oil market and revisions now are much lower for Q1 and the whole year, a month after the breakout of coronavirus and the first estimate. Below are the forecasts and some main comments from OPEC:

Lower demand forecast from OPEC

- OPEC cuts Q1 oil demand growth estimate by 440k bpd on coronavirus outbreak

- 2020 oil demand growth outlook cut by 230k bpd to 0.99 mil bpd

- Coronavirus outbreak adds to uncertainties for oil market this year

- The situation needs continuous monitoring

- To face oil surplus of 570k bpd in Q2

The downward revisions are not surprising as they don’t just see the virus having an impact on the oil market in Q1, but also for larger portions of the year. This is in part why they are trying to push forward with the additional output cuts but so far we are still waiting on a response from Russia regarding the latest proposal. Meanwhile , WTI crude has pushed above the 50 SMA (yellow) on the H4 chart, but the 100 SMA is approaching, where we will try to open a sell forex signal.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.