EUR/USD Remains Extremely Bearish, as the 50 SMA Keeps Pushing it Down

[[EUR/USD]] had been on a bullish trend during the last three months of 2019, but the climb ended on the last day of January, after the year-end cash flows against the USD ended. The sentiment turned negative this year, with the tensions in the Middle East initially, then the coronavirus outbreak, which have kept risk assets declining.

As a result, EUR/USD turned bearish in January, but the real bearish momentum picked up further in February, as coronavirus cases keep increasing exponentially, especially in China. The Eurozone economy will surely suffer because of this and the Euro has been declining lower because of that.

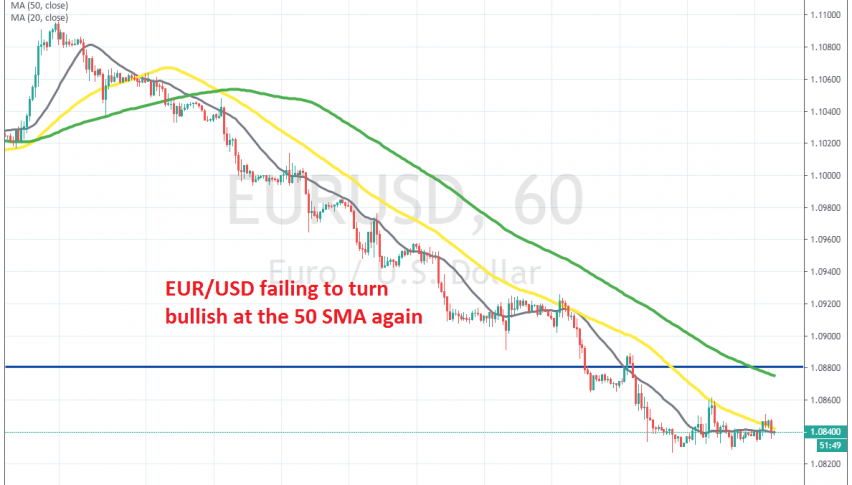

You can see that the trend is pretty strong, since the smaller period moving averages are providing resistance on weak pullbacks and pushing the price lower on the H1 chart. The 20 SMA (grey) and the 50 SMA (yellow) have taken up that job and they have provided decent resistance.

Earlier today we saw a slight retrace higher and this pair climbed above the 50 SMA briefly, but sellers returned and pushed the price back below it. So, sellers remain in control in this pair. We will try to get short on EUR/USD, but will follow the price action around here a while longer.