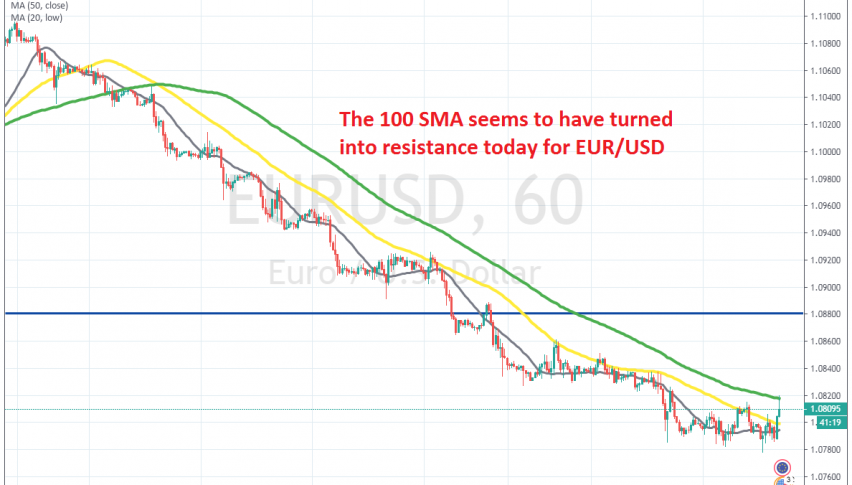

Shorting the Retrace in EUR/USD as Moving Averages are Keeping it Bearish

EUR/USD has been really bearish this month, but it retraced higher today which we decided to sell

[[EUR/USD]] has been bearish since the beginning of this year. The deteriorating sentiment has turned risk currencies such as the Euro bearish, while increasing demand for safe havens such as the USD. As a result, EUR/USD has broken below 1.08 this week and the picture seems pretty bearish.

We saw a retrace higher at the end of January, as the sentiment improved somewhat, but the retrace ended and the decline resumed. This month has been really bearish for this pair, with retraces higher being really weak and moving averages, such as the 20 SMA (grey) and 50 SMA (yellow) have been pushing the price lower.

This shows that the selling pressure is strong, since smaller moving averages are pushing it lower on small time-frame charts, such as the H1 chart. Although, we saw a decent pullback higher in the last few hours. Buyers pushed above those two moving averages, but the 100 SMA (green) is now providing resistance. So, we decided to go short on EUR/USD at the 100 SMA and now the price is pulling back lower again from there.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account