The 100 SMA Rejects EUR/GBP

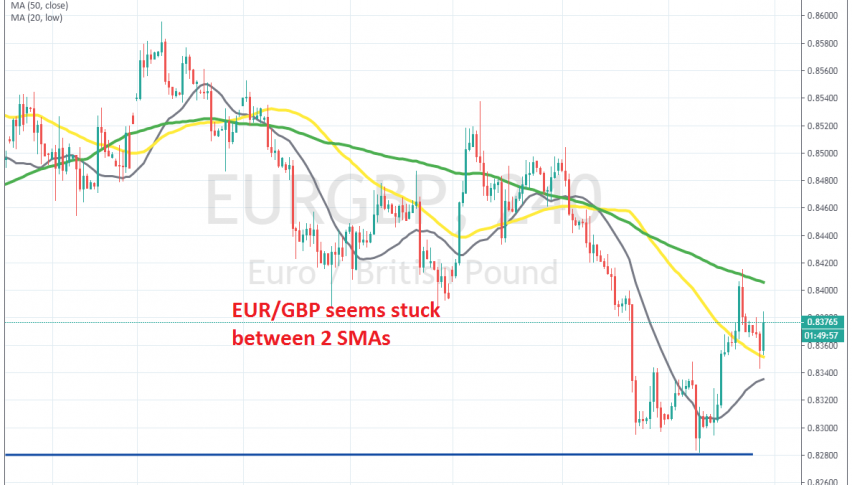

EUR/GBP seems to be stuck between 2 MAs now, as the 100 SMA rejected it on the top side and the 50 SMA at the bottom

EUR/GBP has been on a bearish trend since August last year, after manufacturing fell deep in contraction in the Eurozone that month, increasing fears of a recession. The ECB turned dovish the following month, cutting deposit rates further to -0.50% and reintroducing the QE programme again.

As a result, EUR/GBP has been bearish since then, although we saw a bounce off the 0.8280 level by the middle of last month, as the sentiment from coronavirus outbreak hurt the GBP more than the Euro.The price returned back down, but it bounced again from that area, so it seems like a support zone has formed around 0.8280s.

But, the bounce stopped right at the 100 SMA (green) on the H4 chart. This moving average has been acting as resistance before, reversing EUR/GBP lower several times in 2019. Now, it seems like 100 SMA has turned into resistance again for this pair.

EUR/GBP declined further during the night, but the decline stopped at the 50 SMA (yellow) and has bounced higher now. This looks like a good selling opportunity, so we will try to open a short signal below the 100 SMA, if the EUR/GBP tries it again and it gets rejected for the second time.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account