Markets Now Anticipating A Rate Cut by the FED in March

markets weren't expecting rate cuts from the FED a couple of weeks ago, but coronavirus has spiked odds of a cut in March

•

Last updated: Friday, February 28, 2020

We have seen quite some motion in the rate cut/hike odds during the last couple of weeks or so. By the middle of this month, odds of a 25 bps rate cut by the Fed in the March meeting stood at only 10%. Now, the market has fully priced a rate cut next month, as coronavirus spreads in Europe and the US.

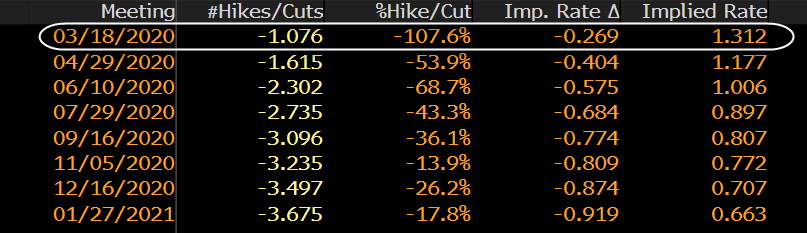

Meanwhile, overall two more cuts are anticipated in the following months until the end of the year, so three rate cuts are fully priced in total in for the remaining ten months of the year with the next rate cut seen in June and the third in September, as odds show in the table above

So far, we haven’t heard any rater cut comments from the FED; they haven’t been vocal with any hints about a move next month but there’s still two-and-a-half weeks to go. If cases of coronavirus kep increasing across the globe, as they are expected, then Donald Trump will get a bonus from the FED. Actually, he might get three bonuses until the US election in October.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.