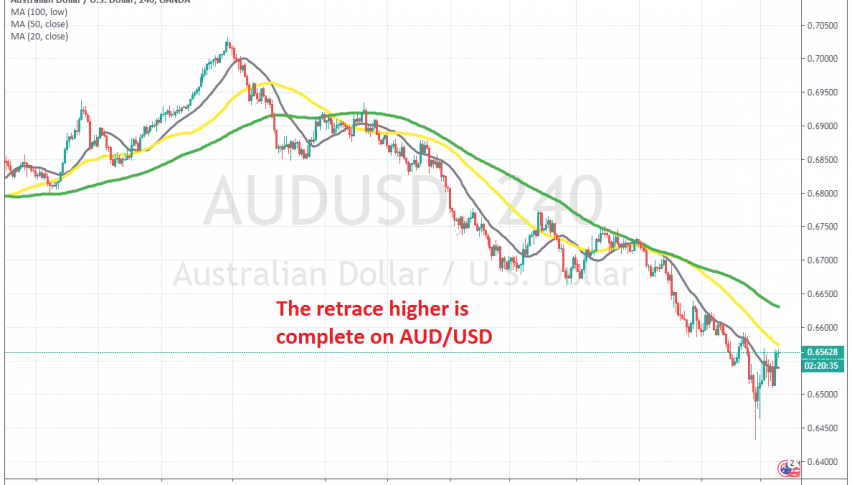

Short on AUD/USD at the 20 SMA on H4 Chart

AUD/USD reversed higher yesterday after being bearish since the start of the year and we decided to sell at the 20 SMA on the H4 chart

[[AUD/USD]] has been bearish for about two years, when the FED was in the middle of a tightening cycle. Although just like in NZD/USD, we saw a retrace higher in the last few months of 2019, as the sentiment improved on prospects of a partial trade deal between US and China.

But, the good times ended with the old year and this year the sentiment turned negative right away, as tensions in the Middle East grew. Then came coronavirus, which has turned the sentiment massively bearish and the data released from China over the weekend showed that the economy has fallen deep in contraction due to the shutdown.

This will reduce the demand for raw materials and other goods from Australia, so the AUD should remain bearish. But, the odds of FED cutting interest rates this month have gone up to 100% and the USD has weakened in recent sessions, mainly shown in EUR/USD which has climbed nearly 4 cents since last week.

As a result, AUD/USD has retraced higher in the last few sessions, but the retrace seems complete now on the H4 time-frame chart. The price has found resistance at the 20 SMA (grey) which has done this job before and it is also overbought. Buyers seem exhausted now and a morning star candlestick formed below the 20 SMA, which is a reversing signal. We decided to sell the retrace, so now we are short on AUD/USD.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account