Daily Brief, March 5: Everything You Need to Know About Gold

On Thursday, the market is likely to follow technical levels today as the economic calendar is a bit light and isn’t offering market moving fundamentals. Investors will also wait for the US Non-farm employment change tomorrow before placing any further bets. Today in the early Asian session, the safe haven metal prices dropped by 0.2%, mainly due to the uptick in Asian stocks. Previously, the yellow metal prices were slightly higher despite the uptick in Asian stocks.

The yellow metal is currently trading at $1,640 per Oz, having defended the 200-hour moving average line at $1,634 during overnight trade. The Asian equities are flashing green with Japan’s Nikkei index adding 0.70% at press time. Other regional heavyweights like South Korea’s Kospi, Hong Kong’s Hang Seng and the Shanghai Composite are also showing modest gains.

US stocks recovered on Wednesday, sending gold lower from $1,652 to $1,635 as lawmakers injected an $8.3 billion emergency coronavirus bill aimed at fast-tracking research and development for treatments and a vaccine, sent stocks higher.

However, the futures on the S&P 500 are currently down 0.80%. The declines in the US index futures could be drawing bids for the safe haven gold. On the other hand, the bid tone around the yellow metal will likely increase if the Asian stocks turn red, taking hints from the S&P 500 futures.

GOLD prices rose by as much as 3% on Tuesday after an emergency rate cut by the Federal Reserve and worry that US cases from the coronavirus had crossed the triple-digit mark made the demand for the haven. The broader outlook for the gold is helpful, because major central banks have seemed cooperative to control the negative impact of the coronavirus outbreak on the economy as both the Federal Reserve and the Bank of Canada have cut rates by 50 basis points this week. The Reserve Bank of Australia also decreased rates by 25 basis points on Tuesday.

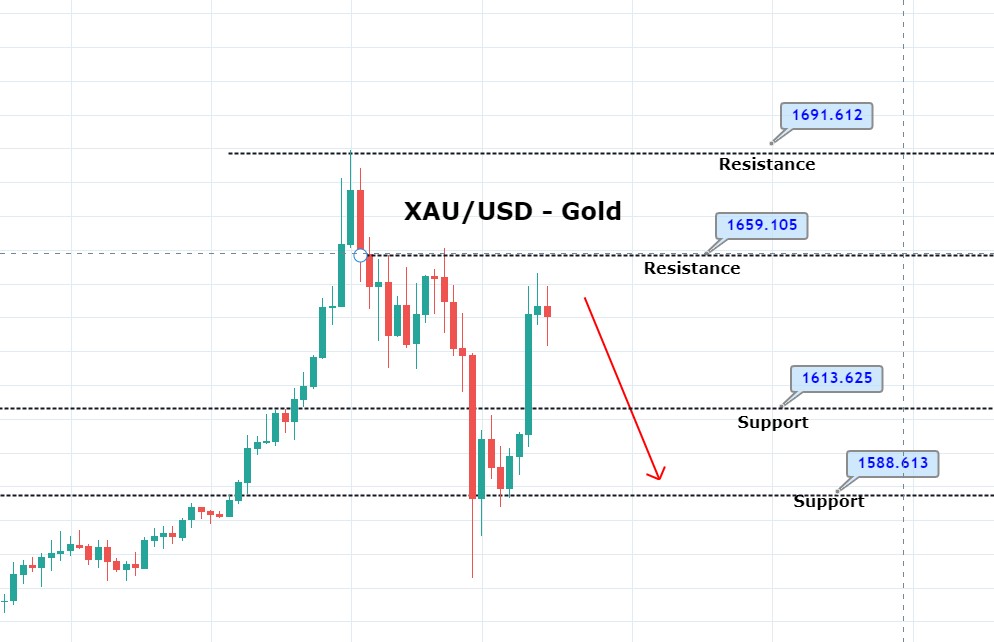

Daily Support and Resistance

S1 1604.39

S2 1621.89

S3 1629.34

Pivot Point 1639.39

R1 1646.84

R2 1656.89

R3 1674.39

The yellow metal gold is rangebound, trading in a narrow range of 1,649 – 1,635. The market may decide further trends tomorrow on the release of NFP figures. However, in the case of market breaks lower today, the next support is likely to be found around 1,629 and 1,611. Whereas, a bullish breakout of 1,649 can lead to gold prices towards 1,660.

Good luck!