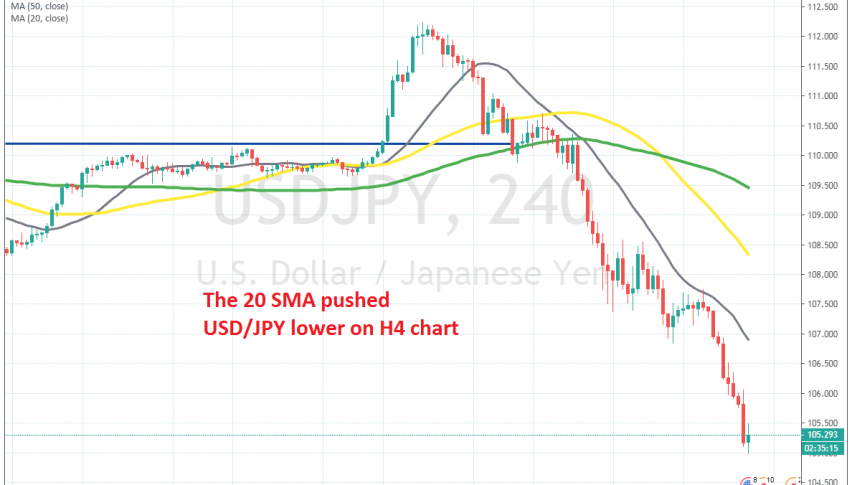

USD/JPY Reversed Lower, After Failing to Break the 20 SMA Yesterday

USD/JPY retraced higher on Wednesday, but the pullback ended right at the 20 SMA on the H4 chart

[[USD/JPY]] turned bearish in the last week of February, as coronavirus spread outside of China and got out of control in Italy. The sentiment turned negative and safe havens such as the JPY rallied higher, which sent USD/JPY around 550 pips lower since then.

On Wednesday, we saw a pullback for this pair, as the sentiment improved a little,, for no particular reason. But, the pullback ended right at the 20 SMA (grey) on the H4 time-frame chart. This shows that the selling pressure is strong, since smaller moving averages are acting as resistance now.

Apart from many major central banks panicking and cutting interest rates in recent days, governments such as in Japan and Italy are also thinking of adding a stimulus package, which has increased fears that the global economy might fall into recession. So, USD/JPY is pretty bearish and it will remain so, as long as coronavirus stays.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account