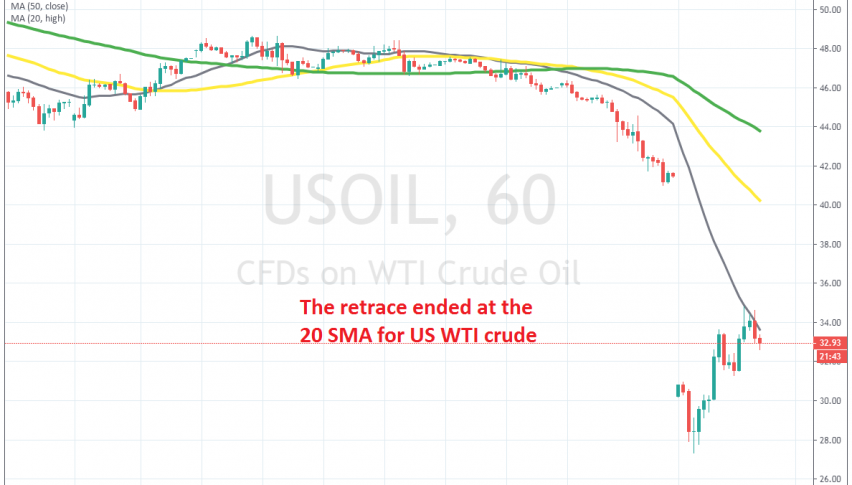

Booked A Hefty Profit Selling the Retrace in WTI Crude Oil

Crude Oil opened with a big bearish gap today, but has retraced higher tothe 20 SMA, where we decided to open a sell signal

Crude Oil has been bearish since early this year, as the outbreak of coronavirus hurt the sentiment. Risk assets such as crude Oil turned bearish due to that and US WTI crude lost around $24 until markets closed last Friday. Today, they opened with a big massive bearish gap for crude Oil, worth around $11 for WTI.

OPEC failed to convince Russia to join in on a 1./5 million barrels/day production cut, and it seems like Saudi Arabia got upset about it. They said to increase production instead, while Russia has replied in the same manner, which has killed any hopes of crude Oil turning bullish anytime soon.

US WTI crude Opened just above $30 last night and bounced a little, but sellers returned and sent it below that big round level. US Oil fell to $27.20 in the Asia session, but has retraced higher now and is trading around 1.35. Buyers look a bit exhausted from the retrace now and the 20 SMA is acting as resistance. So, we decided to go short on Oil and give this crash a go, perhaps we can make some big bucks.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account