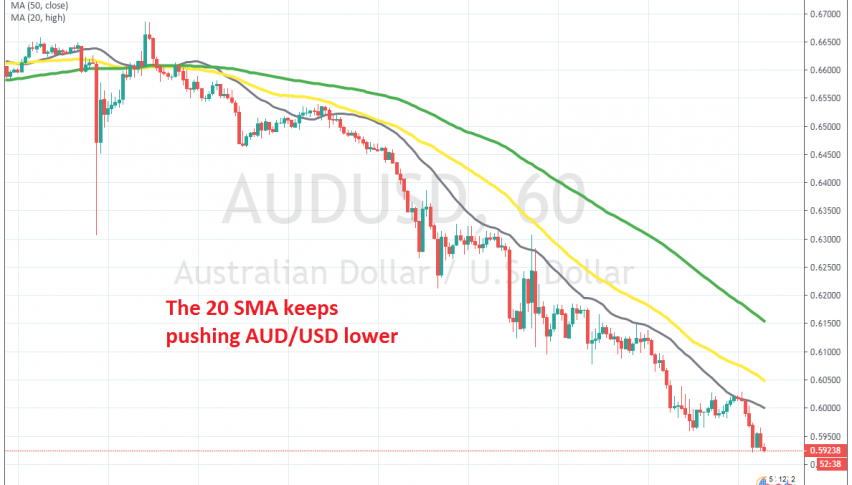

No Pullback for AUD/USD and Other Risk Assets

AUD/USD keeps sliding lower once the 20 SMA reaches the price

The sentiment in financial markets has turned really negative in the last month or so, since coronavirus broke out in Italy. Risk assets turned massively bearish and it seems like there is no end to the decline for stock markets, commodity dollars such as AUD/USD and other risk assets such as Crude Oil.

AUD/USD has been leading the decline, losing nearly 800 pips from top to bottom where we are now, in less than two weeks. This forex pair slipped below moving averages on the H1 chart and those moving averages turned into resistance immediately, especially the 20 SMA (grey).

When smaller moving averages push the price down, it is a strong sign that the pressure on the downside is pretty strong. In fact, sellers are not even waiting for a decent retrace higher to take place. Instead, they are jumping in once the 20 SMA catches up with the price. Another such occasion took place earlier today, but we missed the chance to sell. So, we will try to get short here, once the 20 SMA catches up with the price again.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account