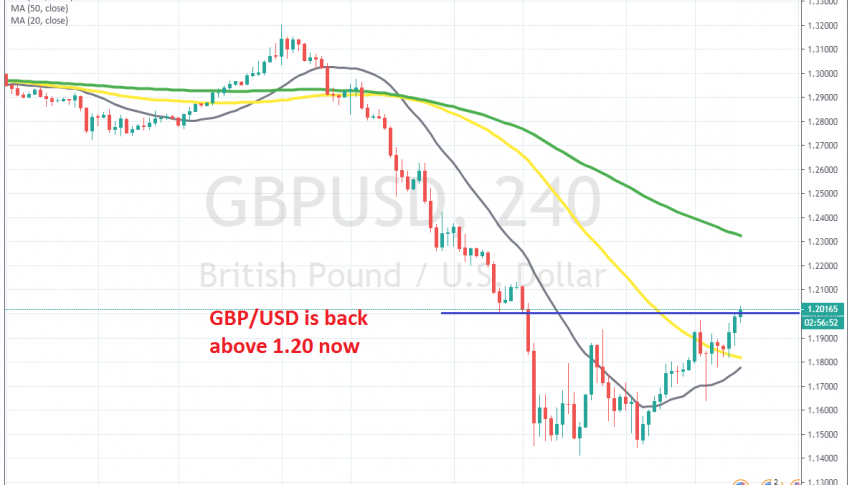

GBP/USD Climbs Above 1.20, As the BOE Remains on Hold

The Bank of England remained on hold today after taking considerable action in recent weeks

Over the last several weeks, the Bank of England has already cut interest rates from 0.75% to 0.25% and then to 0.10%. They also increased QE by £200 billion, introduced new funding for smaller firms, added repo operations, and cut the counter-cyclical buffer to 0%. That is quite a lot of action.

As a result, the GBP crashed lower, with GBP/USD falling to 1.14. Today, the BOE wasn’t expected to do much, and they remained on hold indeed. Below is the report from the BOE meeting today:

- ECB Bank rate at 0.10%

- Gilts purchase target £645 billion (unchanged)

- Corporate bond target £10 billion (unchanged)

- Voting 9-0 to keep the bank rate unchanged

- Economic consequences of virus developments are becoming more apparent

- A very sharp reduction in activity is likely

- There is risk of longer-term damage to the economy

- Unemployment likely to rise rapidly across a range of economies

- If needed, MPC can expand asset purchases further

- Inflation likely to fall below 1% in the spring

- Inflation will be boosted by significant depreciation of sterling

- Economic shock from the virus will prove temporary

- That is if job losses and business failures can be minimized

The next plausible step would either to increase the pace of QE or follow the Fed and go nuclear, but for now they judge the situation as to not be there yet. GBP/USD has retraced higher this week, as the USD gives back some of the gains and this pair has now climbed back above 1.20. Will this last? Let’s see.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account