Safe-Haven Gold Trades Sideways Below $1,600 – What to Expect Next?

Gold prices gained today as Asian equities traded mostly in the red. Australia's ASX 200 slid 2.2% in morning trade, whereas Japan's Nikkei

Today in the early Asian session, the yellow metal prices were flashing green and rose above the $1,600 level mainly due to the fears of expected global economic recession in the wake of the intensifying coronavirus outbreak and lockdowns all over the world. GOLD is currently trading at 1,601.85 and consolidating in the range between 1,595.30 and 1,609.50.

The yellow metal has lost some bullish support in the previous session as the US dollar moves higher, ending the last quarter on the front foot as a relatively illiquid market sees exaggerated moves adding to the upside support. Gold prices gained today as Asian equities traded mostly in the red. Australia’s ASX 200 slid 2.2% in morning trade, whereas Japan’s Nikkei 225 lost more than 1%.

The yellow metal is recently recovering from its previous declines over increased safe-haven demand due to the constant economic turbulence, which is caused by the COVID-19 outbreak. It is worth mentioning that Wall Street dropped 4% because President Trump already indicated to the USA about the painful two weeks ahead. Although, the White House expected that the coronavirus pandemic could take 100,000 to 240,000 lives, even if the US follows social distancing guidelines. The US cases crossed the 200,000 mark, even as the Fed also took measures to keep large banks liquid.

The US and the UK government’s respective policy measures to control the disease will be the key to watch for fresh directions, and the US Jobless Claims will also be essential to watch. Looking forward, there will be high anxiety and uncertainty regarding the trajectory in COVID-19 cases, which will keep traders cautious and force them towards the safe haven investments, while the prospects of another sovereign debt crisis will also be key to watch for further upside in gold. Moreover, the report regarding extending lockdowns in many countries over the world strengthens the bullish trend for the precious metal.

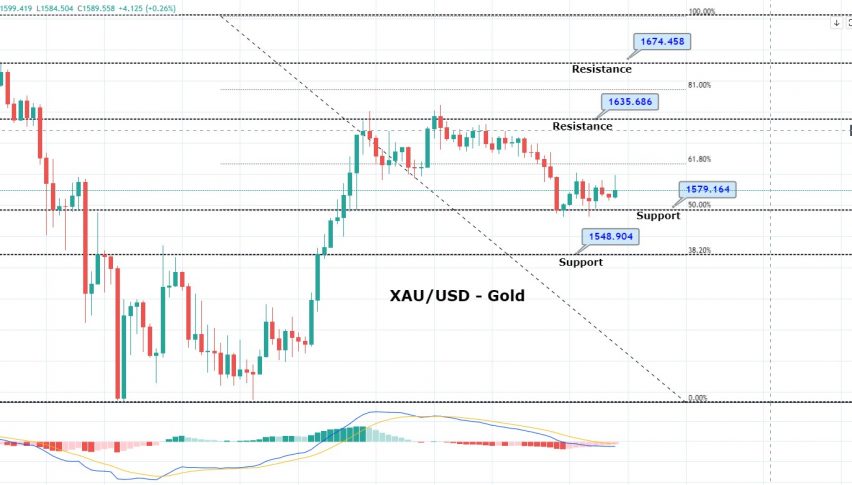

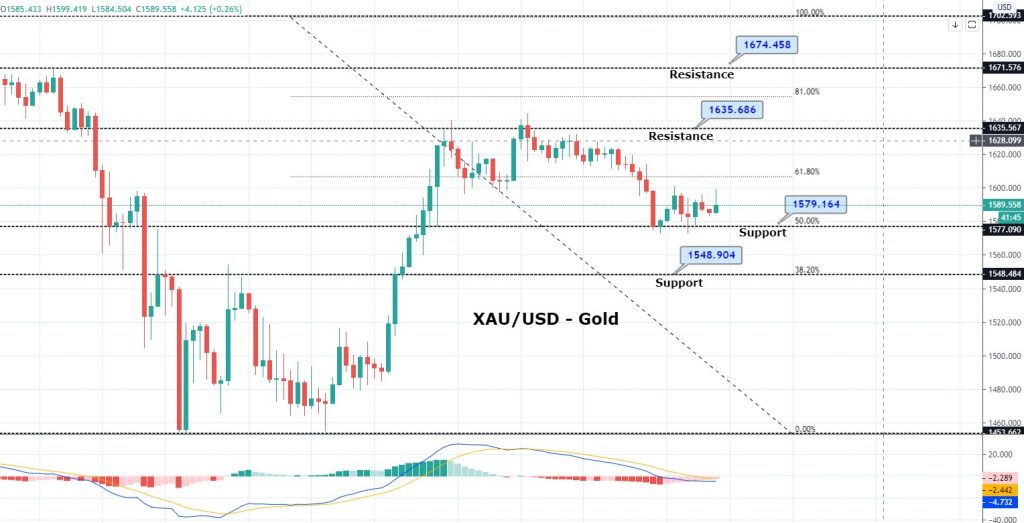

Daily Support and Resistance

S1 1527.36

S2 1557.62

S3 1574.53

Pivot Point 1587.87

R1 1604.78

R2 1618.13

R3 1648.38

Gold’s technical side is staying mostly unchanged as its prices are holding below major resistance area of 1,590 and 1,595. Closing of candles below these levels is suggesting odds of selling in gold, which can lead prices further lower until 1,553. The RSI has crossed below 50, demonstrating chances of more selling in the yellow metal today. Gold’s immediate support stays at 1,572, and violation of this can lead to gold prices until 1,552. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account