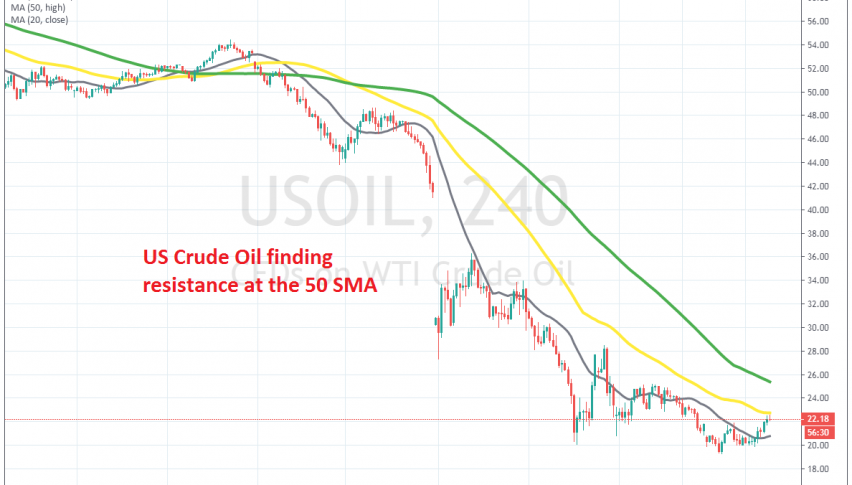

Shorting the Pullback in WTI Crude, as the 50 SMA Catches Up

Crude Oil has retraced higher today, but the 50 SMA has caught up and it rejecting the price now

Crude Oil has turned massively bearish in the last two months, after Russia declined the offer from OPEC to cut production by 1.5 million barrels/day. Saudi Arabia opened a war on Russian Oil companies, which does against the US shale producers as well and US WTI crude has crashed lower, losing more than $45 since early January.

The trend has been really strong, since the smaller moving averages, such as the 20 SMA (grey) have been providing resistance and pushing the price lower on the H4 chart. The pullbacks higher have been quite weak, which also shows the strength of the trend.

So the pressure is totally to the downside, and on Tuesday US WTI crude slipped below the big round level at $20. But, we have seen a pullback in the last few sessions, after Trump said that Iran or its proxies are planning attacks on US bases in Iraq. But, the 50 SMA (yellow) has just caught up and it is already providing resistance on this time-frame. So, we decided to go short below the 50 SMA, after it seems to be rejecting the pullback. Now, let’s wait for the bearish trend to resume.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account