Daily Brief, Apr 8: Everything You Need to Know About Gold – COVID-19 in Play

Good morning, fellas.

The market is exhibiting thin trading volume in the wake of increased number of COVID-19 cases around the globe. Overall, the fundamentals side of the market is likely to remain muted due to lack of high impact economic events. So, the major focus will stay on COVID-19 and technical side of the market.

Today in the early Asian session, the safe haven metal prices were flashing red and traded slightly lower near $1,670 despite the fresh risk-off market sentiment in the wake of intensifying coronavirus fears. In the meantime, the signals for a further stimulus package from the US, Japan and New Zealand favored the risk-on market sentiment.

[[GOLD]] is trading at 1,680.50 and consolidating in the range between 1,670.90 and 1,689.95. However, Monday’s coronavirus (COVID-19) data suggested receding fears of the deadly disease, but the latest figures keep the risk-off sentiment in the market.

Yesterday’s all-time high figures in the UK and the Spanish death toll destroyed early expectations that the virus is losing its grip in the world. Additionally, the latest data from Japan and New York also keep the market’s risk sentiment off. New York reported 731 deaths from coronavirus on Monday, the biggest daily rise. On the other hand, Spain’s daily loss of lives from coronavirus also increased for the first time in five days.

The yellow metal extended its losses from the prior session as gold prices were bearish by 0.22% at $1,680. Gold prices tend to run in the opposite route from stocks, but as of now, both are moving in the same direction for the second day in a row. Asian stock markets opened on Wednesday with losses. As we already mentioned, the BOJ, RBNZ, and the Trump administration officials showed willingness for further stimulus.

As a result, the 10-year US Treasury yields dropped 3-basis points to 0.71% from the previous recovery. Moreover, stocks in Asia are also moderately weak, whereas the US stock futures remain downbeat after Wall Street closing. Looking forward, gold traders will keep their eyes on COVID-19 clues for near-term direction. In addition, the FOMC minutes for the early-March Fed meeting will likely also offer intermediate moves.

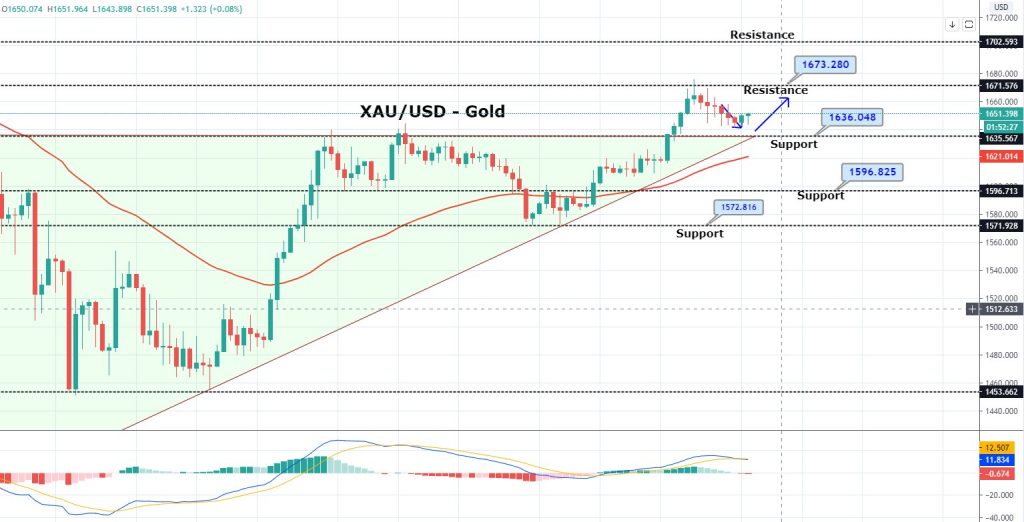

Daily Support and Resistance

S1 1597.1

S2 1625.48

S3 1636.8

Pivot Point 1653.86

R1 1665.18

R2 1682.24

R3 1710.62

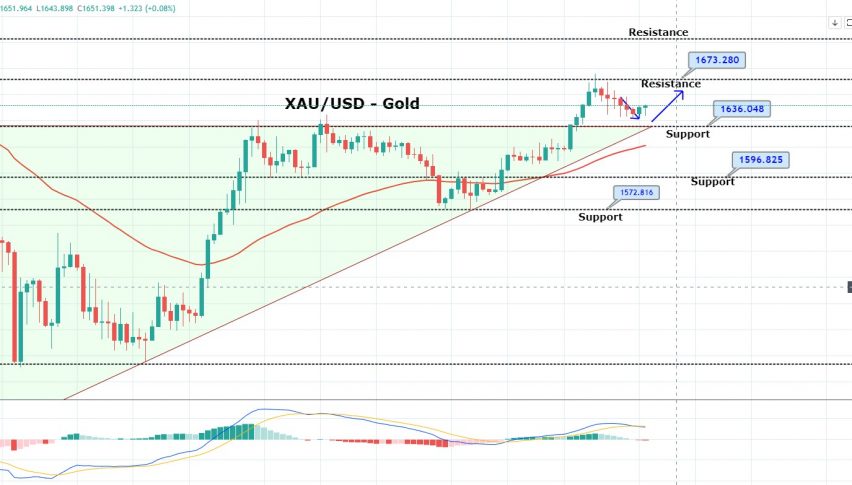

Gold – XAU/USD – Technical Outlook

Technically, the precious metal gold still seems bullish around 1,643 support and bearish below 1,653 resistance. Above 1,653, the next resistance can be seen around 1,671, and violation of this level may head towards the next resistance level of 1,689.

Conversely, the support stays around 1,643, and bearish breakout of this level can open further selling trend until 1,635 and 1,623. Overall, trading bias remains neutral as investors are keeping an eye on COVID-19 and a weaker dollar. Good luck!