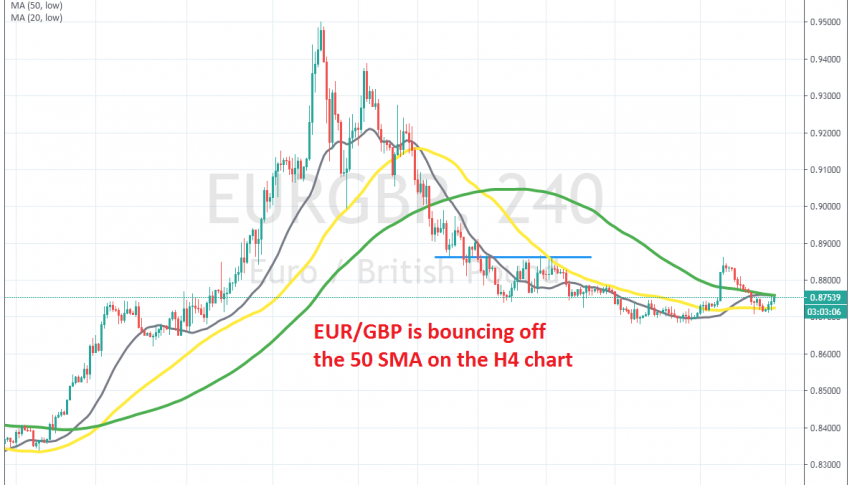

The Bullish Reverse is Taking Shape in EUR/GBP, But Buyers Will Have to Push Above the 100 SMA

EUR/GBP is trying to turn bullish, but the 100 SMA is a major obstacle for buyers

EUR/GBP surged higher in late February and in the second half of March, as coronavirus spread in the UK, increasing fears of a recession in the country, which is proving to be true and the GBP crashed lower. But, the surge ended by the middle of last month and this pair turned bearish in the last month or so.

As a result, EUR/GBP lost around 8 cents from the top, but that’s still 5 cents short of the 13 cents increase in the previous three weeks, when this pair was bullish. This means that the larger trend in this pair is still bullish. Moving averages used to provide support during the climb, then they turned into resistance during the fall.

The 50 SMA (yellow) has done a good job as support and resistance on both directions. Now it seems to have turned into support again, after EUR/GBP climbed above that moving average. But, the buyers are facing the 100 SMA (green) on the H4 chart, so they will have to push above it for the bullish trend to resume again. If that happens, we might go long on this pair.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account