The Decline in Eurozone PPI for March Will Soften CPI Further in April

The PPI inflation is heading lower and the CPI is also declining as coronavirus shut-down continues

•

Last updated: Tuesday, May 5, 2020

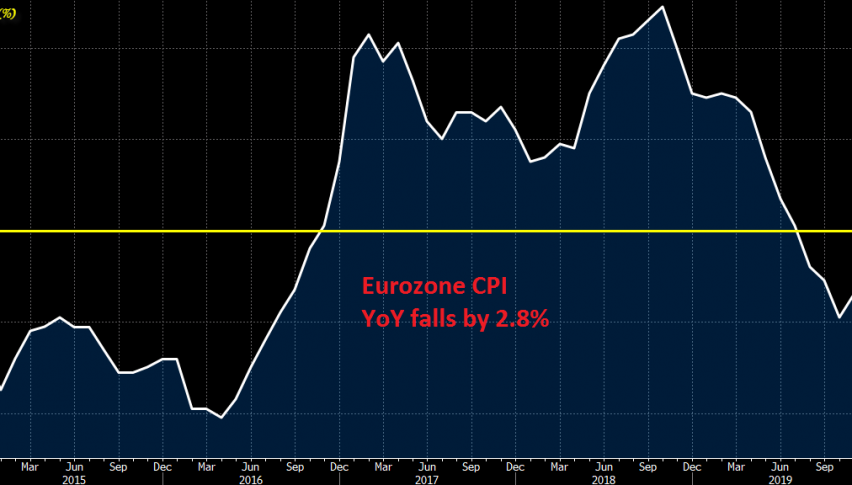

The PPI (producer price index) report from the Eurozone was released earlier this morning. In February, we saw this inflation indicator fall into negative territory, declining by 0.6%, which was revised lower to -0.7%. As energy prices fell, producer prices also declined, since they use a lot of energy. This will translate to lower CPI (consumer price index) in April. Below is the PPI report:

Eurozone March PPI Released by Eurostat – 5 May 2020

- March PPI -1.5% vs -1.4% m/m expected

- February MoM PPI stood at -0.6%; revised to -0.7%

- PPI March YoY -2.8% vs -2.7% y/y expected

- January MoM PPI stood at -1.3%; revised to -1.4%

Amid the drop in energy prices and the fallout from the virus outbreak, producer and import prices have also declined sharply. That said, this is a lagging indicator of inflation pressures since this pertains to March data, but still the trend isn’t a healthy one.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.