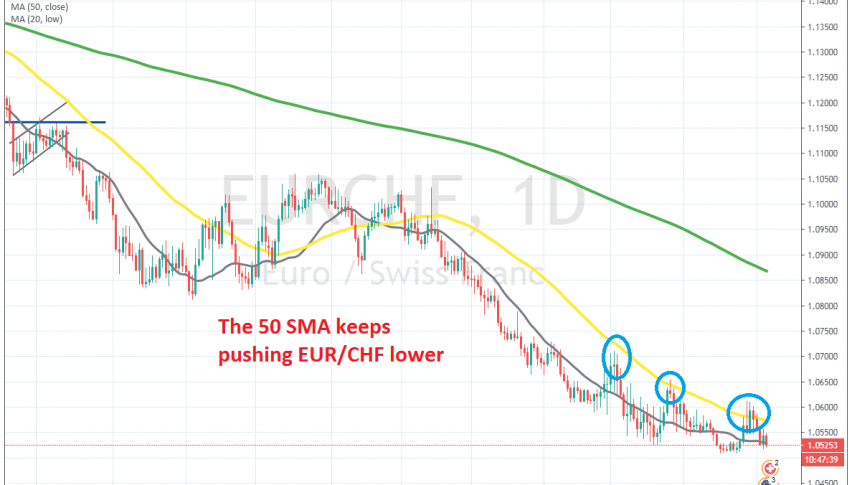

EUR/CHF Reverses Down at the 50 Daily SMA Again

EUR/CHF climbed above the 50 SMA last week as it retraced higher, but reversed back down again

EUR/CHF has been trading on a bearish trend for about two years, since it reversed at 1.20 on April 2018. The sentiment started turning negative with the start of the trade war between US and China, which turned the attention to safe havens, such as the CHF.

The trend picked up pace in 2019, as the global economy weakened, and the price remained below moving averages during all of last year. Buyers weren’t able to find enough strength to push the price above all moving averages, which shows that the selling pressure has been quite strong.

This year the downtrend has picked up even more speed, after the breakout of the coronavirus flu, which I already passed in May with very mild symptoms. As a result, the 20 SMA has been pushing the price higher in the first two months of this year and the 50 SMA has taken its place since early March. At the end of last month, EUR/CHF climbed above the 50 SMA for a while, but it returned down, and so the trend remains bearish. We will try to sell around the 50 SMA if this pair retraces back up again.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account