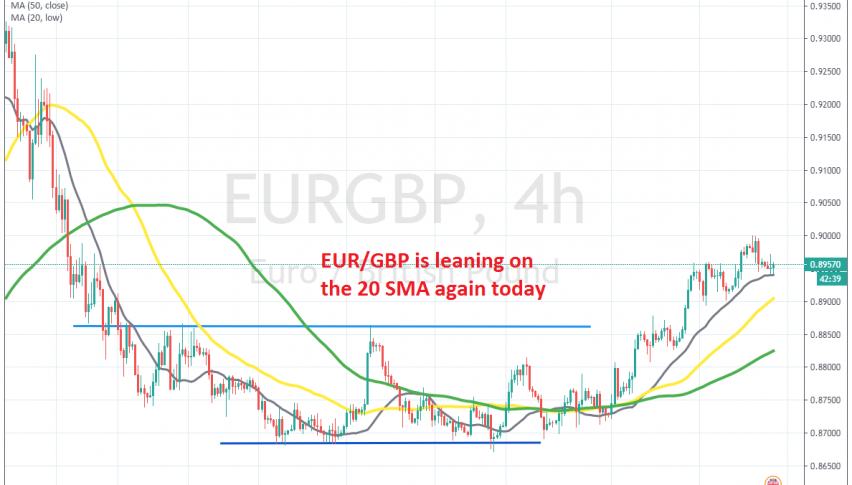

The 20 SMA is Keeping EUR/GBP Supported

EUR/GBP retraced lower yesterday, but the 20 SMA is holding its ground well

EUR/GBP surged 12 cents higher in early March, as the GBP crashed, following the outbreak of coronavirus in Europe and the UK. This pair reached 0.95 by March 20, but reversed down as the GBP recovered from the crash and EUR/GBP fell below 0.87, where it formed a base.

This pair traded in a 150 pip range, consolidating there for more than a month. But, the range was eventually broken by the middle of this month and EUR/GBP has been climbing higher for a few weeks. During this time, the 20 (grey) has been providing support for this pair.

This moving average was providing resistance when EUR/GBP was on the way down, but now it seems to have turned into support. The 20 SMA has been holding during retraces down and today is the latest example of that. Yesterday we saw this pair retrace lower, but the 20 SMA held once again and the price formed a doji candlestick, which is a bullish reversing signal. Now the price is bouncing from that moving average, so let’s hope that the bullish trend resumes again soon.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account