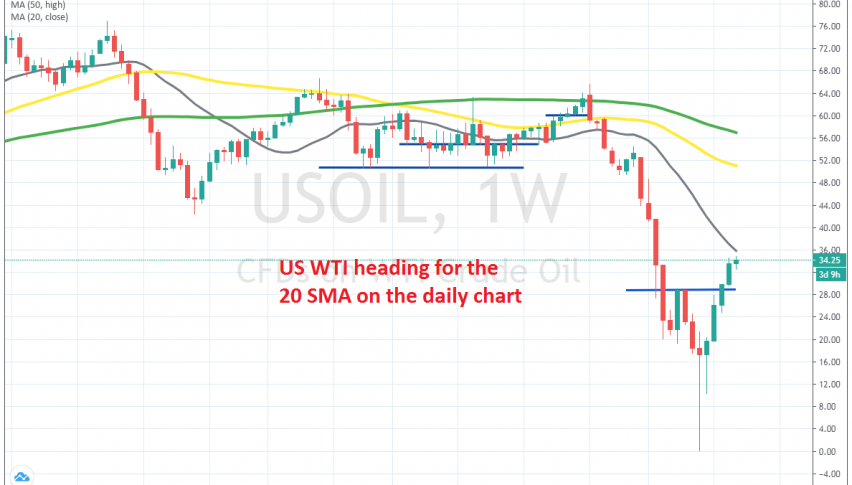

Crude Oil Heads for the 20 SMA, As the Bullish Reversal Continues

Crude Oil has bounced nicely since bottoming below $0 in April

Crude Oil went through some really difficult times so far this year. It started this year at around $65, but then the decline started, after US-Iran tensions didn’t materialize into a was in the Middle East, which would have disrupted production and transport for crude Oil in the region.

So, crude Oil didn’t have any reason to rally and it turned bearish, falling to around $40. Then OPEC failed to convince Russia to join them in cutting production by 1.6 million barrels/day and WTI crude Oil fell below $20. We saw a climb to $29 after they finally convinced Russia and cur production by 9.7 million barrel/day.

But then US WTI crude fell to -$37/barrel, as Saudis were flooding markets with cheap Oil and US producers didn’t have anywhere to store their Oil. But, crude Oil came back from the dead and has been making quite a reversal in the last several weeks.

US WTI crude formed a hammer candlestick by mid March, which is a strong bullish reversing signal. The following weekly candlestick have been all bullish, so the reversing pattern worked well and now US Oil is trading at around $34.40 and heading for the 20 SMA (grey), which is standing around $2 higher. We will follow the price action to see if there is hesitation wound there. We the price action suggests, we might open a sell signal up there.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account