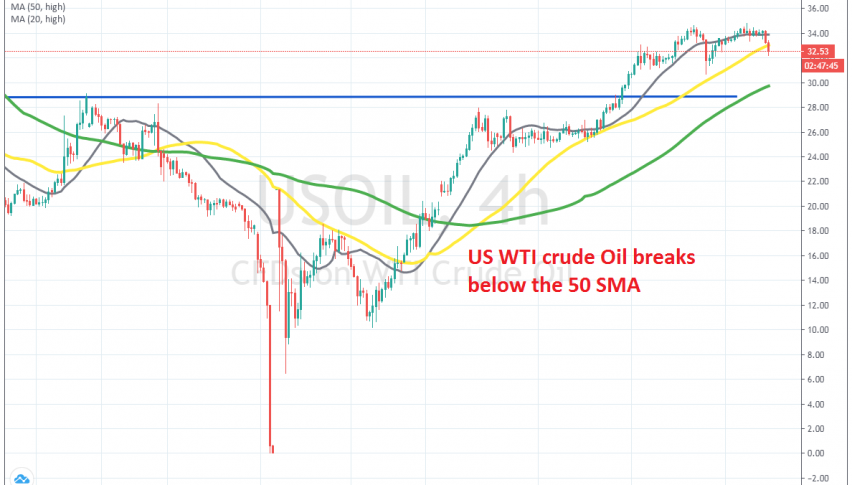

Crude Oil Falls Below the 50 SMA

Crude Oil seems to have turned bearish today and the 50 SMA is now broken on the H4 chart

Crude Oil made quite a comeback in the last several weeks, after it tumbled lower in two phases in March and paril. The first decline came after Russia refused to join OPEC+ in cutting production, which sent US WTI crude below $20 in March, while th second wave of selling came after Saudi Arabia flooded markets with cheap Oil, leaving no storage room for US producers.

As a result, US WTI crude Oil fell below $0 for the first time ever and it reached -$37.50. But, the decline stopped by April 20 and crude Oil has been climbing higher since then. We saw the 50 SMA (yellow) turn into resistance for some time in April, but eventually that moving average got broken.

The 50 SMA turned into support in May as the price moved above it and has been pushing the price higher throughout this month. Although, today we are seeing a bearish reversal and the price has fallen below the 50 SMA again on the H4 chart. Now, WTI Oil seems to be heading for $31 and then $30, where we might open a buy signal, if sellers start to get exhausted down there.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account