Daily Brief, May 28: Everything You Need to Know About Gold Today

Good morning, traders.

The yellow metal gold prices closed at $1709.24 after placing a high of $1715.95 and a low of $1693.78. Overall the movement of gold remained flat throughout the day. GOLD prices fell in the earlier trading session on Wednesday amid the easing of coronavirus lockdown restrictions from all over the world, which fed optimism that the global economy could recover soon. Prices fell and hit two-week lows below $1700, but in the late session, gold prices rebounded on the back of new remarks from Washington that Hong Kong territory was no longer autonomous of China.

Just when we thought that the trade war took a back seat, another statement from the US came in and escalated US-China tensions. On Wednesday, the United States Secretary of State, Mike Pompeo, informed the US Congress that the Trump administration no longer considers Hong Kong as autonomous from mainland China.

This made the US withdraw preferential trade and financial status that the former British colony has enjoyed since it was handed over to China in 1997. It means all US tariffs on China would extend to Hong Kong as well. It would also make travel to the US for people of Hong Kong more complicated, and it would likely cause a departure of many emigrants living and working in Hong Kong.

This decision from the US came in after Beijing imposed Chinese national security laws over Hong Kong territory. The Parliament of China is expected to approve a proposed security law that would reduce the separate legal status of Hong Kong on Thursday. Chinese legislation was aimed at handling separatist, rebellion, and terrorist activities in the city.

The relationship between China and the United States got worse over US allegations that China tried to cover up the coronavirus pandemic and pressured the WHO against any early action to fight it. And after that, long-standing tension started between the US & China over trade, human rights, religious freedom, and the status of Taiwan.

The new Cold War between China and the US raised the demand for the yellow metal in the financial markets as safe-haven appeal emerged and supported prices. This cold war will keep driving yellow metal prices higher as tensions will remain in place till the presidential elections.

In the early trading session on Wednesday, gold prices fell below the support level $1700 on the back of increased risk appetite after possible vaccine reports raised hopes for quick economic recovery along with the optimism over reopening of US economy from COVID-19 lockdowns. However, gold started to rise after a new announcement from Washington and managed to recover its daily losses, ending day on the same level it started its day with.

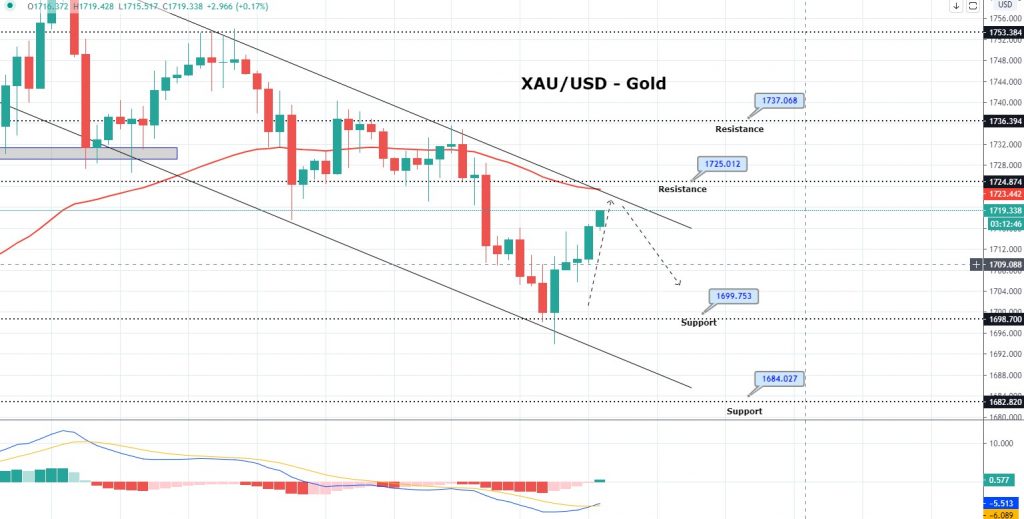

Daily Technical Levels

Support Resistance

1690.74 1719.09

1673.62 1730.32

1662.39 1747.44

Pivot Point: 1701.97

Gold prices traded in line with our forecast to help us secure 80 pips yesterday. Currently, the precious metal is heading north towards the resistance area of 1,723, which is extended by the downward channel. On the 4 hour chart, the precious metal has also closed a bullish engulfing pattern, which is suggesting chances of buying until 1,725 area. While the 50 EMA will be there to extend resistance at the same level of 1,725, let’s look for selling blow 1,723/25 area today.

Good luck!