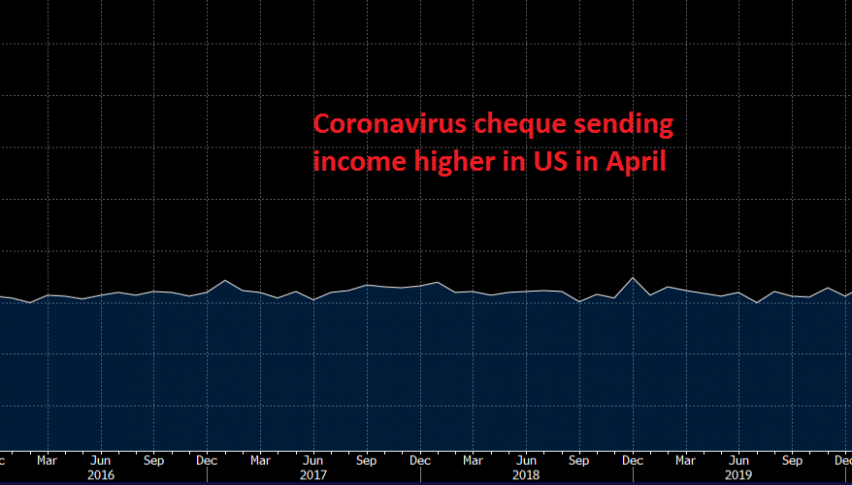

Income “Increases”, Spending Falls, Consumer Sentiment Remains Low

US personal spending declined, while the income increased due to the Trump cheque

•

Last updated: Friday, May 29, 2020

There was quite a lot of economic data being released today. It started off with Japanese retail sales, then the German retail sales, followed by the French consumer spending, all of which showed some major declines in April. Inflation fell to just 0.1% in the Eurozone later on, but at least core CPI held up well. The Canadian economy showed a major decline of 7.2% in March, while the numbers from the US were pretty bad as well, despite looking sort of mixed at first glance.

Highlights of the April 2020 personal income and spending report:

- April personal spending -13.6% vs -12.8% expected

- March personal spending was -7.5

Details:

- Personal income +10.5% vs -6.0% expected

- Prior personal income -2.2%

- PCE deflator m/m -0.5% vs -0.6% expected

- PCE deflator y/y +0.5% vs +0.5% expected

- PCE core deflator m/m -0.4% vs -0.3% expected

- PCE core deflator y/y +1.0% vs +1.1% expected

That personal income number is incredible. It speaks to the skew in additional unemployment benefits. The system was designed so workers would get an additional $600 per week. That put the income received at the national average. The thing is, the workers getting laid off weren’t making average wages — they were low-paid employees. So for many, not working has paid much better than working, some as much as double.

US May Consumer Sentiment Report From the University of Michigan

- Prelim was 73.7

- April final was 71.8

- Current conditions 82.3 vs 83.0 prelim

- Expectations 65.9 vs 67.7 prelim

- 1-year inflation +3.2% vs +3.0 prelim

- 5-10 year inflation +2.7% vs +2.6% prelim

The market is patient with the lack of improvement in May but if the preliminary June number is below 80 then the market is going to start to bury the v-shaped narrative and start to worry about a slog.

On the inflation side, the rise in expectations is notable because it’s the highest since March 2016 and a rise from 2.3% in March. There are people keeping a very close eye on inflation expectations. I think it’s too soon to move markets but if there’s a recovery in 2021, inflation is going to be top-tier headline data.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.