EUR/USD Jumps 150 Pips Higher, As US 10-Year Yields Break Above 0.80%

[[EUR/USD]] has been bearish for more than two weeks, but this pair formed a base at 1.0750 in the last two month, which has held well as a support zone. Although, EUR/USD turned bullish by the middle of May, after comments form European leaders about a European coronavirus recovery plan.

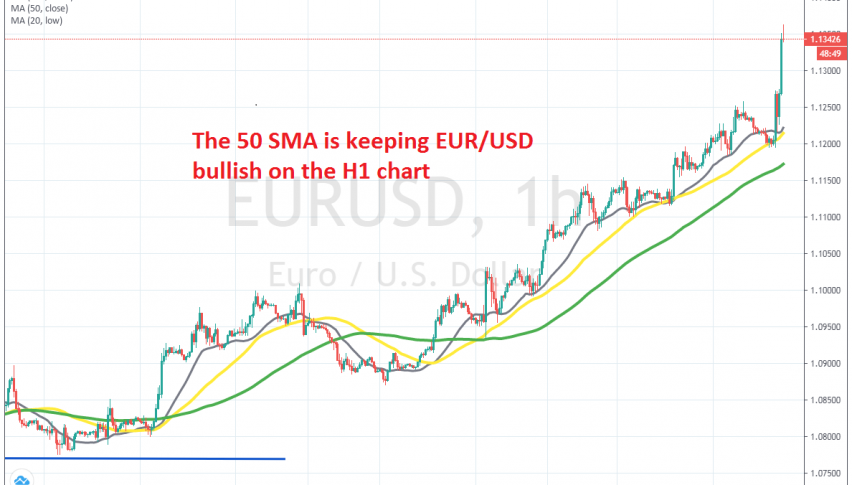

The trend picked up pace in the last week of May and moving averages such as the 20 SMA (grey) and the 50 SMA (yellow) turned into support for this pair. These are small moving averages, which shows that the upside pressure is quite strong.

These moving averages have been providing support during pullbacks and pushing the price higher. The last occasion took place earlier today. EUR/USD retreated 50 pips lower, from 1.1250 to 1.12, but once the 50 SMA caught up with the price, the sentiment turned bullish again and this pair bounced 150 pips higher.

This opens the door for 1.15 now, which was the high after the spike in March, although EUR/USD has given back some of the gains now. So, pullbacks to these moving averages are good opportunities to go long form, but we should be careful as we approach 1.15. But, I think that EUR/USD will remain bullish until then.