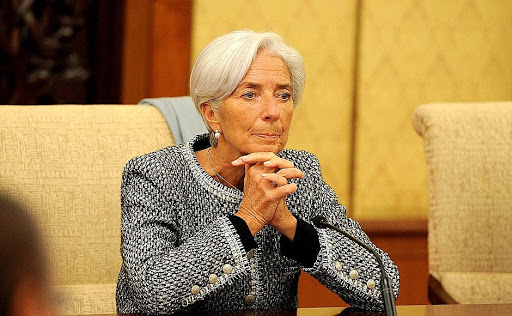

ECB’s Lagarde Wants Capital Markets Union

Christine Lagarde is picking up on markets union in the Eurozone, where Draghi had left it

•

Last updated: Monday, June 8, 2020

The European Central Bank Christine Lagarde was speaking to the European Parliament a while ago. She sees unprecedented economic contraction in Europe from the measures to contain the spread of the virus, meaning the massive and prolonged lock-down.

Everyone knew that; it would have been better if she told us that at the beginning, because if life gets stopped, for three months then logic tells you that the economy will dive and that’s what happened. Now Lagarde is just stating the facts after the destruction has already happened. Anyway, she is pushing for markets union in the Euro area, but I don’t think that will happen, especially after this pandemic and the lock-down.

Lagarde Speaking in the European Parliament

- Covid 19 pandemic and measures to contain the spread of the virus, have caused an unprecedented contraction of economic activity in the euro area

- Financial conditions are still tighter today then at the outset of the Covid 19 pandemic

- ECB’s decisions will make sure that higher borrowing needs by fiscal authorities associated with the necessary fiscal response to the crisis, will not translate into materially higher interest rates for the private sector

- ECB’s crisis related measures are temporary, targeted and proportionate

- ECB’s actions are proportionate to the severe risks to our mandate that we are facing

- ECB continually monitors the proportionality of its instruments

- We remain fully committed to our mandate

Q&A in the European Parliament

- Confident good solution will be found on German court

- ECB will provide any help needed on German rolling

- Capital markets union would bolster role of euro

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.