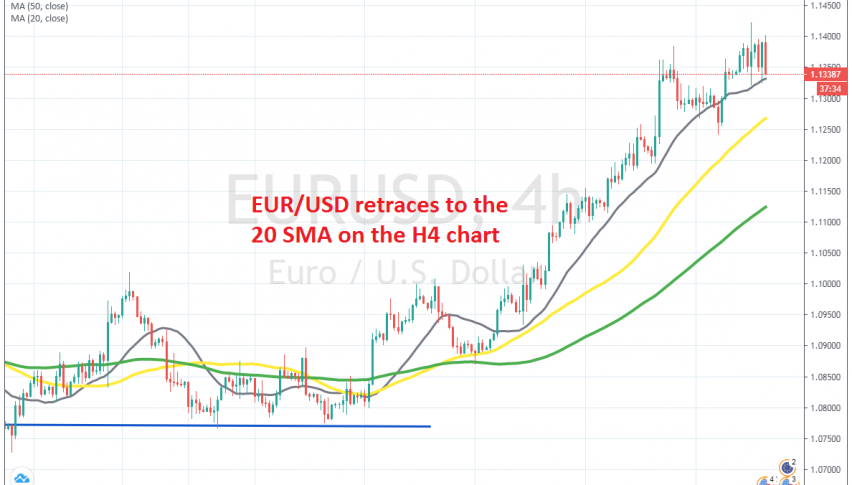

EUR/USD Retreats Back to the 20 SMA

EUR/USD has retreated lower today after it climbed higher, following the FED meeting yesterday

[[EUR/USD]] has turned quite bullish since the middle of May and the bullish momentum picked up further pace this month. During this time, the 20 SMA (grey) has been acting as support for this pair, pushing the price higher, although it was broken earlier this week.

But, the price reversed up and climbed above this moving average again, resuming the bullish trend. Yesterday, we saw another attempt to the upside, after the FED meeting, which confirmed the dovish bias for as long as it takes to get the economy back on its feet.

The dot plot didn’t wasn’t showing any rate hikes until late in 2022, which sent the USD another 100 pips lower across the board and EUR/USD higher. This pair reached 1.1420s after that meeting, but it has been retracing lower today and now we find it at the 20 SMA (grey) on the H4 chart once again. Now I’m thinking about going long on this pair since the trend is still bullish and the retrace seems almost complete.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account