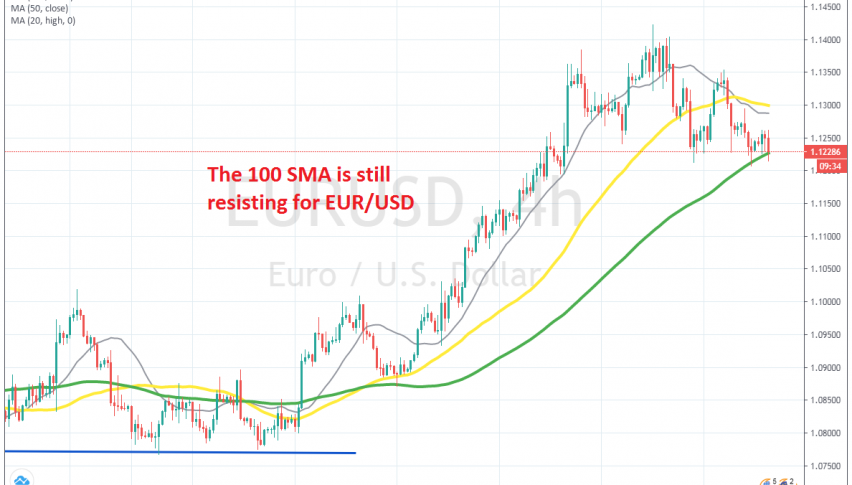

Let’s Hope the 100 SMA Gives Up Soon As Support in EUR/USD

EUR/USD has turned down again today, but the 100 SMA is still acting as support on the H4 chart

Earlier this week we decided to open a long term sell forex signal in EUR/USD . This pair climbed to 1.1420s in the first week of this month, as the USD turned quite weak, but buyers couldn’t push higher to 1.15, which was resistance earlier this year and in the second attempt they failed to reach 1.14.

That was a sign that the bullish momentum was over for this pair and we decided to go short as buyers tried the upside for the third time. So, we went short above 1.13 after the two doji candlesticks on the H4 chart and now this pair has turned lower again.

But, the 100 SMA (green) held as support for this pair yesterday and EUR/USD bounced higher off this moving average. Although the price has turned bearish again now, the 100 SMA is still holding on as support. If the 100 SMA goes, then it will open the door for 1.11 and 1.10 eventually. But, let’s hope the 100 SMA gets broken soon and the bearish momentum continues, pushing this pair lower.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account