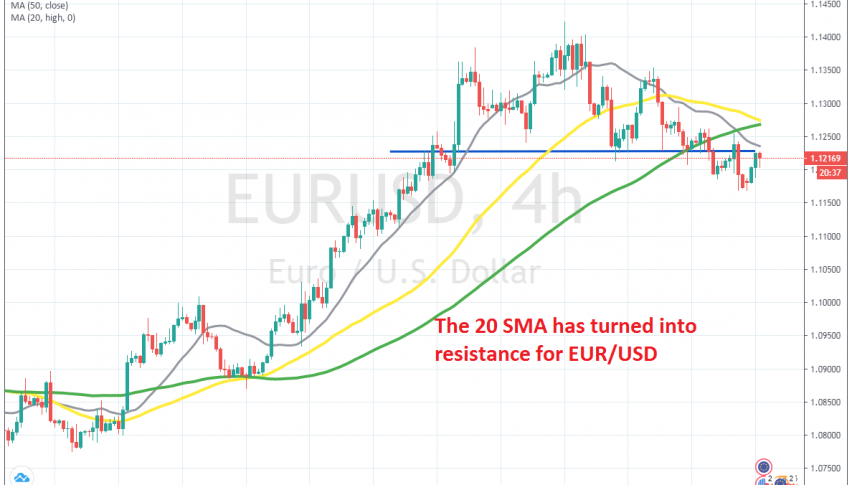

Selling EUR/USD Below the 20 SMA

EUR/USD has retraced higher today, but buyers are giving up below the 20 SMA

[[EUR/USD]] was pretty bullish for about a month, from the middle of May until the middle of this month. But, the bullish momentum came to an end two weeks ago, when this pair showed that it wasn’t able reach 1.15 and wasn’t able to even hold on to gains above 1.14.

The USD weakness also came to an end by that time, after continuing for a month and the bearish reversal came in this pair. We opened a sell signal above 1.13 and closed it for around 100 pips of profit. The price declined below 1.12 last week, which opened the door for 1.11 and 1.10.

As shown on the H4 chart, the 20 SMA (grey) use to provide support for EUR/USD when the trend was bullish. But, it seems to have turned into resistance when the trend changed. Today EUR/USD pulled back 50 pips higher, but buyers are having second thoughts at the 20 SMA now. The pullback seems complete on this time-frame, so we decided to open a short term sell forex signal just below it, with a stop above the 20 SMA. Now we are waiting for the bearish trend to resume again.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account