Markit Manufacturing Makes Improves Again in June, But Still Remains in Contraction

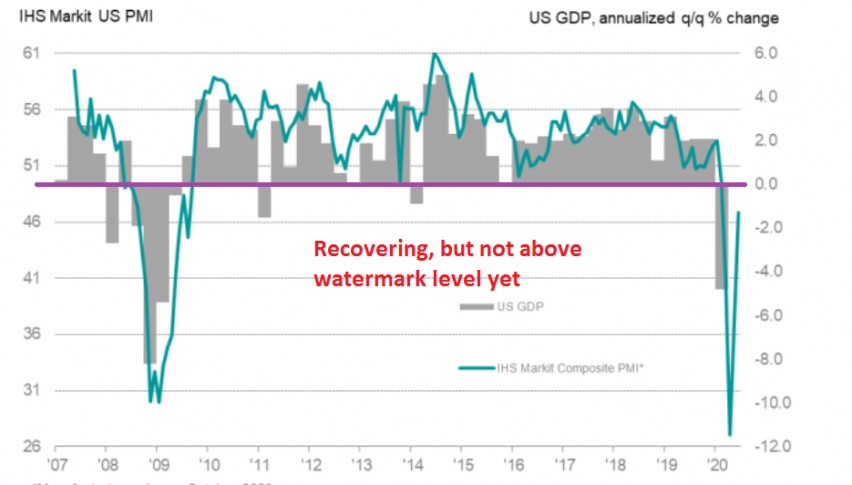

After the big contraction during lock-downs, manufacturing and services are recuperating across the globe, as today’s date from Europe showed. This is expected, since the lock-downs are ending and life is resuming again. Although, not all sectors are expanding yet, since the PMI indicators remain below 50 points, which is the flat level.

The Markit reports for US manufacturing and services were released a while ago and they showed another nice improvement, compared to previous months. This is a rebound but it’s not as good as hoped, especially after all the beats in Europe today. The general message is that manufacturing and services continued to contract, albeit at a much slower pace than in May.

US June Markit Manufacturing and Services PMIs

- Prelim Markit US PMI 49.6 points vs 50.0 expected

- May was 39.8 points

- Output 47.8 points vs 34.4 in May

- New orders 49.5 points vs 34.6 in May

- Composite index at 46.8 points vs 37.0 in May

Services:

- Services 46.7 points vs 48.0 expected

- New business 48.7 points vs 36.9 expected

- May services were 37.5 points

Comments from Chris Williamson, chief business economist at IHS Markit:

“The flash PMI data showed the US economic downturn abating markedly in June. The second quarter started with an alarming rate of collapse but output and jobs are now falling at far more modest rates in both the manufacturing and service sectors. The improvement will fuel hopes that the economy can return to growth in the third quarter.However, although brief, the downturn has been fiercer than anything seen previously, leaving a deep scar which will take a long time to heal. We anticipate that the US economy will contract by just over 8% in 2020. The coming months will therefore see the focus turn to just how much recovery momentum the economy can muster to recoup this lost output. Any return to growth will be prone to losing momentum due to persistent weak demand for many goods and services, linked in turn to ongoing social distancing, high unemployment and uncertainty about the outlook, curbing spending by businesses and households. The recovery could also be derailed by new waves of virus infections. Continual vigilance by the Fed, US Treasury and health authorities will therefore be required to keep any recovery on track.”

Check out our free forex signals

Follow the top economic events on FX Leaders economic calendar

Trade better, discover more Forex Trading Strategies

Related Articles

Comments

Subscribe

Login

0 Comments