Daily Brief, July 01 – Everything You Need to Know About Gold Today!

Good morning traders,

The yellow metal GOLD continues to trade with a bullish bias, on the back of an increased safe-haven demand in gold. The precious metal gold prices closed at $1,780.37 after placing a high of 1785.97 and a low of 1764.67. Overall, the movement of gold remained bullish throughout the day. Gold surged to its highest level for eight years on Tuesday, as the safe-haven demand for gold remained alive, due to the increased fears of a resurgence of new coronavirus cases. Gold continued to rally towards the level of $1,800 per ounce.

Some states in the US have reversed re-openings and closed their businesses again, amidst fears of the second wave of the coronavirus. On Tuesday, the US Federal Reserve Chairman, Jerome Powell, warned that a second wave of coronavirus infections would damage the confidence and undermine the economy.

He was confident that the second outbreak would force the government and the people to withdraw from economic activities again. He said the worst part would be the undermining of public confidence, which was crucial for getting economic activities back on track.

In Republican Arizona, gyms, bars, movies and theaters, and water parks have been shut down for at least 30 days. These institutions were allowed to reopen in mid-May, but the rise in coronavirus infections prompted the government shut them down again. Houston’s health care professionals have urged residents to remain at home, wear masks, and cancel gatherings. Houston residents have received an emergency alert on their phones to stay home, as virus infections have spiked again.

He said that the US had entered a new phase of economic recovery “sooner than expected”, but that it was still facing the labor market challenges and the spread of COVID-19. The positive data suggests that the US is on its way to a V-shaped recovery, but Powell was cautious, stating that consumer confidence cannot be fully restored until the virus is fully contained. He also highlighted the inequality of the labor market recovery. He said that women, African-Americans, Hispanics, and low-wage workers had suffered a great deal, due to the coronavirus. He suggested that all government levels should implement a relief policy for as long as necessary, in order to save the economy from falling into a deep depression.

Powell’s comments suggest an extraordinarily uncertain economic outlook for the United States, weighing heavily on the US dollar, which helped gold prices to gain on Tuesday.

On the data front, at 18:45 GMT, the Chicago PMI dropped to 36.6 against the expected 45.0 in June, weighing on the US dollar and supporting gold. The CB Consumer Confidence increased to 98.1, from the 91.6 forecast in June, supporting the US dollar.

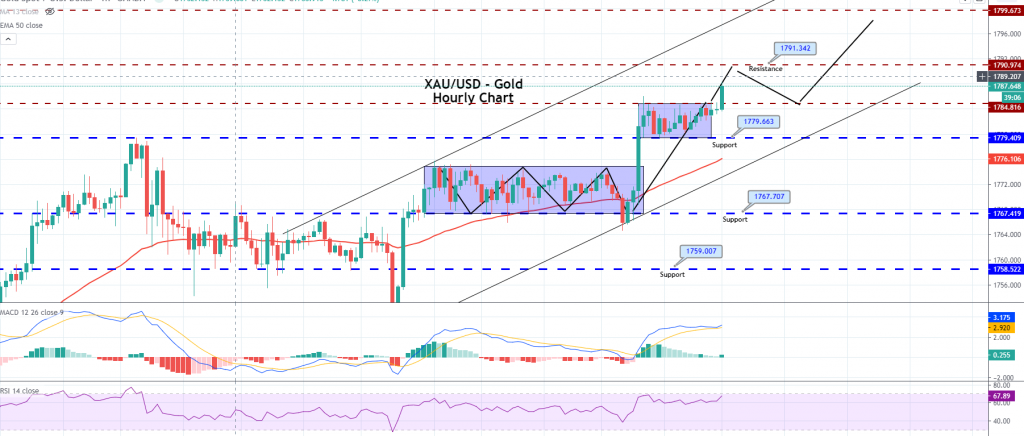

Daily Support & Resistance

1781.85 1810.35

1764.40 1821.40

1753.35 1838.85

Pivot point: 1792.90

On the technical front, the XAU/USD is trading with a bullish bias at the 1,784 level, holding right below an immediate resistance level. A bullish crossover at the 1,785 level can open up further room for buying until the 1,791 and 1,799 levels. Fellas, the bullish bias is supported by most technical indicators, such as the MACD and RSI holding, in a buying zone above the 0 and 50 levels, respectively. While the 50 periods, EMA is also supporting the precious metal at the 1,775 level today. Despite this, we should wait for a bullish breakout of 1,785, in order to capture a buy trade. Stay tuned, as we will be sharing a trading signal on gold very soon. Good luck!